[ad_1]

For more than a month, the price of the USD/JPY currency pair has been moving in a strong uptrend range amid a strong investor abandonment of the Japanese yen. This is one of the most prominent safe havens for investors in times of uncertainty and was supposed to make solid gains as the Russian/Ukrainian war continues. Investors balanced between the future of the US Federal Reserve policy, amid a distinguished performance of the US economy, and the lax policy of the Japanese central bank and the continued provision of stimulus to the Japanese economy in the face of the effects of the epidemic and, most recently, the Russian war.

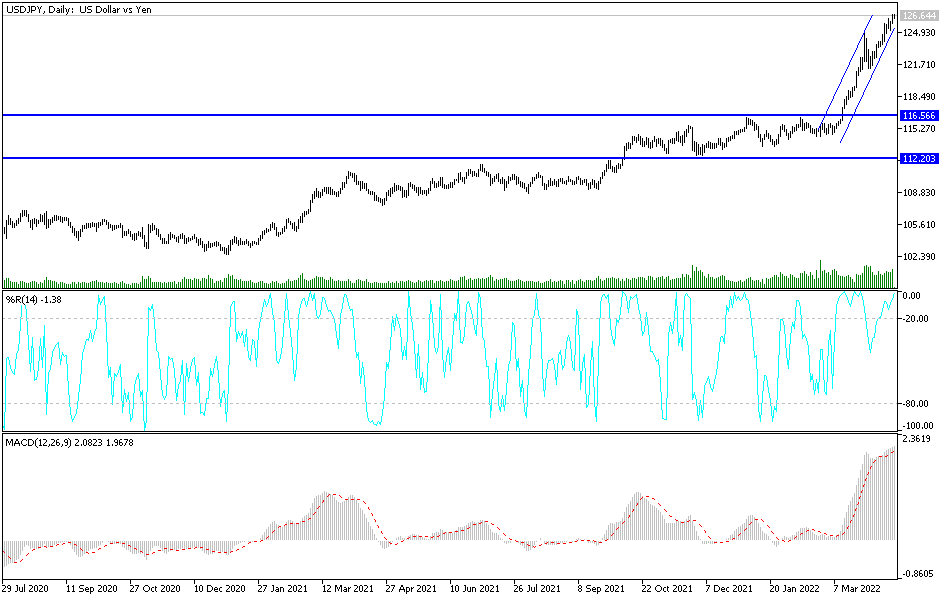

The gains of the dollar-yen pair reached the resistance level of 126.68, the highest in 20 years, and settled around the 126.30 level at the beginning of this week’s trading. This stimulated the bulls and expectations for the future to move towards the next historical psychological resistance 130.00 if the currency pair’s gains factors continued and profit-taking did not start.

The US dollar is still reaping gains, with expectations of more US interest rate hikes during 2022 to face the fiercest levels of inflation in the country in 40 years. On the other hand, pressure on the Bank of Japan comes from two sources. First, the rise in global rates has pushed the 10-year Japanese government bond yield to nearly 0.25% yield curve control ceiling. There is something to be said for the IMF’s advice to target a shorter maturity period.

Secondly, the general inflation rate in Japan was on the rise, but the main reason for this was food and fresh energy. In March 2021, the annual rate of the headline CPI was -0.4%. It is expected to rise to 1.0% in March 2022 when it is announced this weekend. A year ago, if food and fresh energy were excluded, the Japanese CPI was flat. Last month, it was expected to be at -0.8%. Starting with the April report, the base rate will rise. Moreover, it will turn positive with lower prices for wireless services last year compared to the 12-month comparison. As a result, real interest rates will fall even more.

It is common for observers to argue about the race to rock bottom, as everyone is looking for weaker coins, however this is not true. What is true is that central banks usually want the currency to be consistent with the direction of their monetary policy. A strong currency could dampen efforts to ease financial conditions, for example. Likewise, currency weakness when financial conditions tighten is counterproductive.

Companies don’t always want a weaker exchange rate. Let’s take Japan, for example. The Japanese yen fell to its lowest level against the dollar in 20 years. A recent Reuters poll showed that three-quarters of Japanese companies say a weak yen is hurting their businesses. A common fear is that the depreciation of the yen will weaken consumption and capital investment. Almost half believe that exchange rate developments will undermine profits, more than a third said they will harm profits “to some extent”, and one-eighth said the impact will be “significant”.

USD/JPY Technical Analysis: Near term and hourly performance, USD/JPY appears to have pulled back recently to complete the channel breakout before assuming a sideways trend formation. This indicates a reversal of the uptrend in the market. Therefore, the bears will target short-term profits at around 125.95 or lower at 125.50. The bulls are looking to resume the upside by targeting profits at around 126.70 or higher at 127.00.

In the long term and according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of a sharply bullish channel. This indicates a strong long-term bullish momentum in the market sentiment. Therefore, the bulls will target long-term profits at around 127.94 or higher at the next psychological resistance of 130.00. On the other hand, the bears will target potential pullback profits at around 124.09 or lower at 121.56 support.

[ad_2]