[ad_1]

The only thing I think you can count on at this point is a lot of noise and wrecking of accounts.

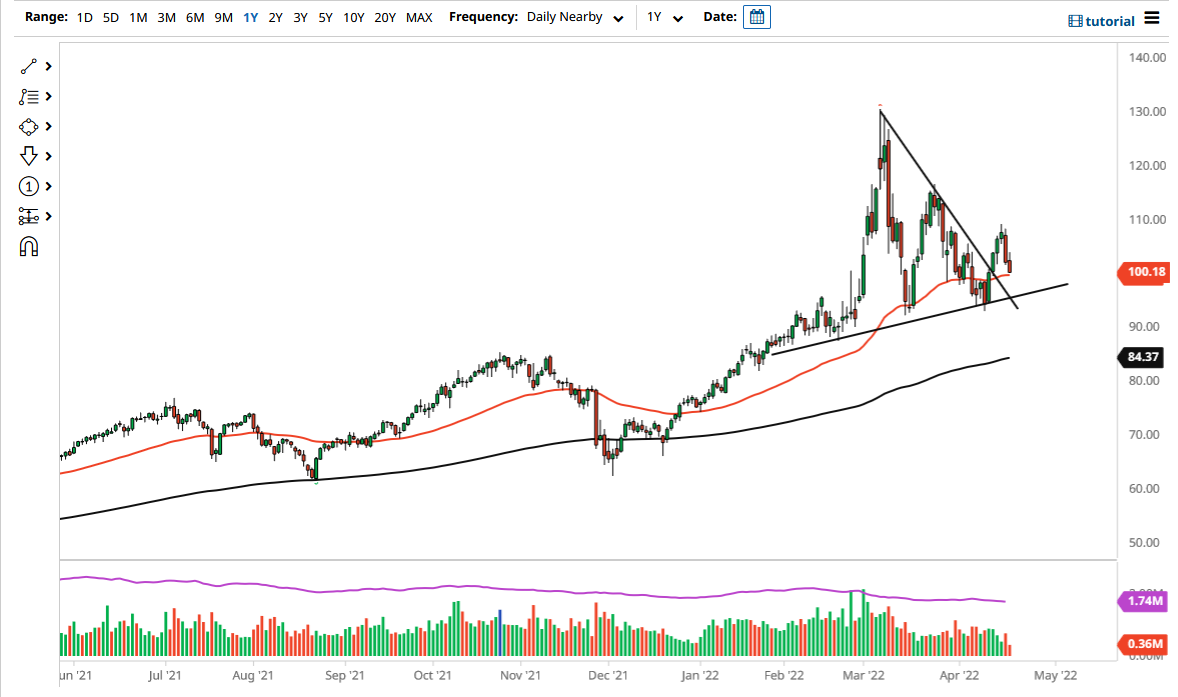

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Wednesday but has pulled back enough to show signs of hesitation again. Ultimately, the market looks as if it is going to try to test the 50 Day EMA, which is a technical indicator that a lot of people in this market pay close attention to. Furthermore, underneath there we have the uptrend line that is so prevalent on the chart, and the $100 level.

At this juncture, the WTI Crude Oil market has shown itself to be rather resilient, but the last couple of days have been rather tough. This makes a certain amount of sense because there are a lot of concerns out there as to whether or not we are going to continue seeing inflation drive crude oil prices higher, or if we will see some sort of demand destruction. The only thing I think you can count on at this point is a lot of noise and wrecking of accounts. Because of this, you must be cautious about the overall size of your trade, but at this point in time, you are more likely than not going to be challenged by all of the volatility that seems to be in this market.

If we were to break down below the uptrend line, then I think it could change everything and the crude oil market will almost certainly drop to the $90 level. After that, the market will challenge the 200 Day EMA, sitting currently at the $84 $37 level. On the other hand, if we turn around a break above the top of the candlestick for the trading session on Wednesday, then it is likely that we could go higher and look to reach the $110 level, which of course has a certain amount of psychology attached to it and has offered a little bit of resistance as of late. At that point, then we could continue the overall longer-term uptrend, thereby allowing the market to really start to take off at this point. A fundamental reason to think that oil may go higher is the fact that the European Union is supposedly going to completely wean itself off of Russian oil in the short term, so it will be interesting to see what that does to the supply and demand dynamics.

[ad_2]