[ad_1]

For the third consecutive day, the gold market has been subjected to profit-taking operations since it tried to breach the psychological top of $2000 an ounce at the beginning of this week’s trading. The recent selling operations pushed the price of gold towards the support level of $1940 an ounce before settling around the level of $1955 an ounce at the time of writing the analysis. The decline in the US dollar helped limit the losses of gold. The US dollar lost ground as investors reacted to less hawkish comments from Chicago Fed President Charles Evans and Atlanta Fed President Rafael Bostic.

Chicago Fed President Charles Evans said Tuesday that he favors a half-point rate hike in upcoming meetings and a rate hike to 2.25-2.50% by the end of the year. Atlanta Federal Reserve Chairman Rafael Bostic said a 75 basis point rate hike is not on the table, and expressed concerns about the impact of faster policy tightening on the US economic recovery.

Bostick added that the neutral interest rate could range between 2% and 2.5% and that the funds rate could be as high as 1.75%.

On the economic news front, a report from the National Association of Realtors showed that US existing home sales fell 2.7% to an annual rate of 5.77 million in March after declining 8.6% to a downwardly revised rate of 5.93 million in February. Economists had expected existing home sales to decline 3.7% to a rate of 5.80 million from 6.02 million originally reported for the previous month.

Overall, higher mortgage rates complicate the home buying equation during the spring home buying season, which is the typically busiest period for home sales. Interest rates are rising after a sharp rise in 10-year Treasury yields, reflecting expectations of higher interest rates in general as the Federal Reserve moves to raise short-term interest rates in order to combat rising inflation.

Higher rates can reduce the pool of buyers and cool home price growth which is good news for buyers. Higher rates also weaken their purchasing power. Currently, the housing market continues to favor sellers as buyers compete for fewer homes, leading to bidding wars, often paying the selling price much higher than the owner is asking.

The median home price in March jumped 15% from a year ago at this time to $375,300. Accordingly, NAR said this is the highest level ever in the data since 1999. On average, homes were sold within just 17 days of entering the market last month. It was 18 days in February. In a more balanced market between buyers and sellers, homes typically stay on the market for 45 days. As usual in the spring, the number of homes on the market in March increased from the previous month. There were about 950,000 properties on sale at the end of March, up 11.8% from February, but down 9.5% from March 2021.

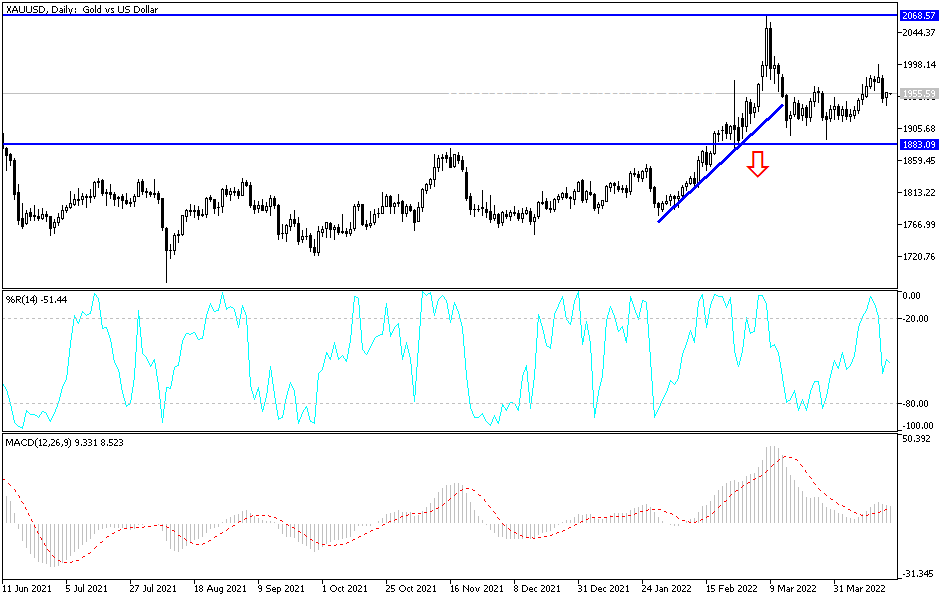

According to the technical analysis of gold: Despite the recent profit-taking, the price of gold did not come out of the general upward trend. There will be no actual reversal of the trend without the gold price moving towards the support levels of 1910 dollars and the level of 1880 dollars an ounce, respectively. At the same time, it is the most appropriate levels to think about to buy gold again, as mentioned before. This is despite the tendency of the global central banks to tighten their policy strongly this year, which is negative for the yellow metal, but it is supported by other factors, most notably the Russian / Ukrainian war, which still exists in addition to the continuing concern of the global pandemic spread from China.

On the upside, the resistance of 1975 dollars will remain important for gold’s move towards the psychological top of 2000 dollars for an ounce again. The gold market will be affected today by the announcement of European inflation figures and the statements of monetary policy officials from Britain, the United States and the Eurozone

[ad_2]