[ad_1]

Gold prices fell strongly towards the support level of $ 1881 an ounce, coinciding with a sharp rise in the price of the US dollar amid expectations of violent policy tightening by the Federal Reserve

The weakening of the Euro in the wake of the Russian gas cuts to Poland and Bulgaria also contributed to the sharp rise in the value of the US dollar. According to the performance, the US dollar index DXY, which measures the performance of the US currency against a basket of other major currencies, rose to a new high in 25 months, rising to the level of 103.28. The index is still high with a fairly strong gain of 0.54%.

On the US economic news front, US pending home sales declined for the fifth consecutive month in March, according to a report from the National Association of Realtors. NAR said pending home sales fell 1.2% to 103.7 in March after tumbling 4% to 105.0 in February. Economists had expected pending home sales to fall 1.6%.

The US Federal Reserve is expected to raise US interest rates aggressively while intensifying its fight against inflation. In this regard, the Federal Reserve Chairman indicated that the US central bank may raise short-term interest rates by twice the usual amount in upcoming meetings, starting next week. It has already raised its key overnight interest rate, the first such increase since 2018.

Bond yields have generally risen throughout the year as investors prepare for higher rates. The yield on the 10-year Treasury rose to 2.82% from 2.77% late Tuesday. Wall Street remains focused on inflation’s path forward amid persistent threats from Russia’s war against Ukraine and the virus epidemic.

Natural gas prices rose 24% over the last day in Europe and the euro weakened after Russia said it would cut supplies to Poland and Bulgaria. Natural gas and oil prices were already on the rise as the pandemic subsided and demand increased, but the Russian invasion of Ukraine added to the price hike. Crude oil and natural gas prices have soared so far in 2022, making gasoline and heating more expensive for consumers.

China’s strict lockdown measures have also heightened concerns about slowing economic growth due to the damage being done to the world’s second largest economy. The flow of industrial goods has been disrupted by the suspension of access to Shanghai, home to the world’s busiest port, and other industrial cities including Changchun and Jilin in northeastern China.

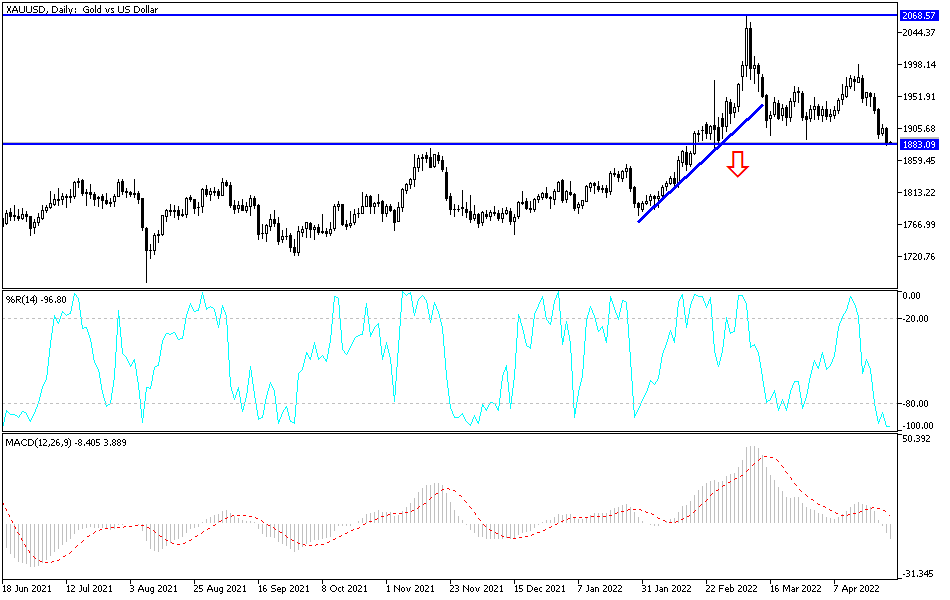

According to gold technical analysis: The recent strength of the US dollar was a major driver of the decline in the price of gold towards strong buying levels, and the closest to them are currently 1880 dollars, 1862 and 1845 dollars, respectively. I still prefer the strategy of buying gold from every bearish level, as the yellow metal has strength factors that still exist, which are currently represented in the current global fears of China being affected by the renewed outbreak of the epidemic. This is in addition to the continuation of the Russian/Ukrainian war and its negative consequences for the future of the global economy.

On the upside, the return of stability above the psychological resistance of 1900 supports the return of the bulls’ movement again. The gold market will be affected today by the level of the US dollar and the extent of investors’ appetite for risk or not, as well as the reaction from the announcement of the US economic growth rate and the number of US weekly jobless claims, and before any surprises from the Japanese central bank.

[ad_2]