[ad_1]

Now that we have digested a lot of those gains, the market seems to be ready to make its next move.

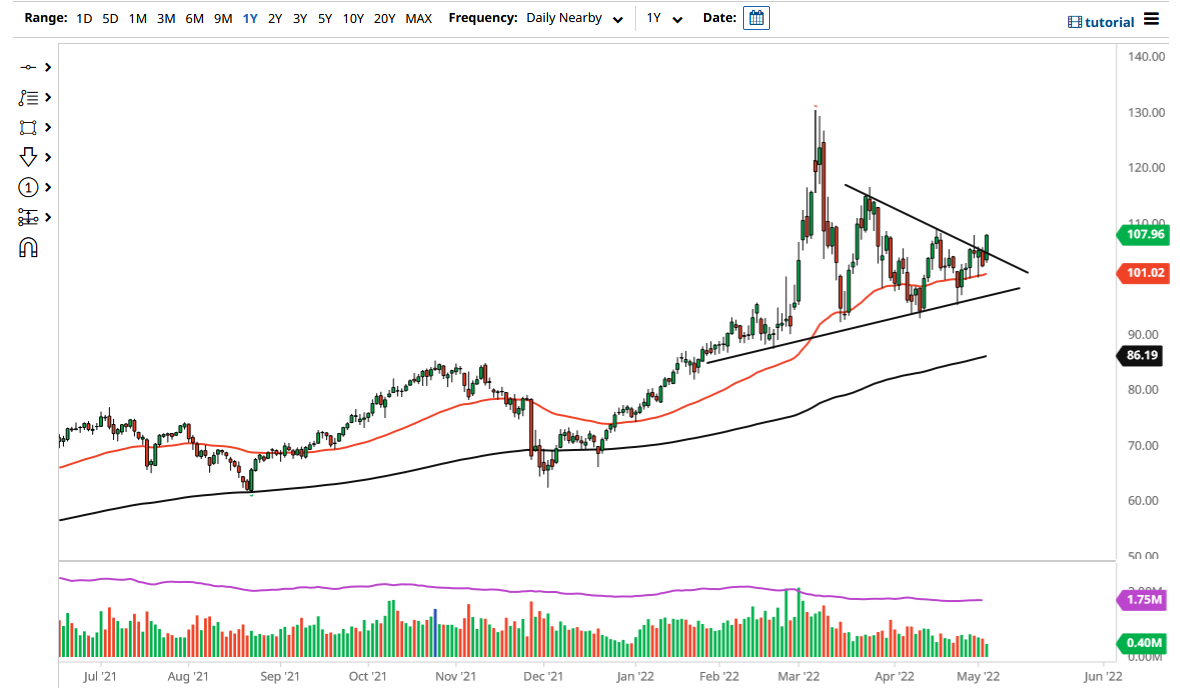

The West Texas Intermediate Crude Oil market has rallied significantly during the Wednesday session to break out of the triangle again, and now it looks as if we are going to threaten the top of the shooting star from the Friday session. This is a very strong sign, and therefore breaking above the candlestick kicks off a buying opportunity as far as I can see. After all, it would be a breach of major resistance.

Oil prices are making great trade opportunities

At this point, the 50 Day EMA continues to be a major support indicator, sitting just above the $100 level. The market will continue to see a lot of interest in that area on pullbacks, as we have the reopening trade driving up demand going forward. Furthermore, we have been in an uptrend anyway, and then of course the fact that the 50 Day EMA tends to attract a lot of attention anyway will be yet another reason to think that people will be buyers on dips.

The uptrend line underneath should continue to offer support as well, so as long as we can stay above there, I think we still have an opportunity for buyers to take the reins. On the other hand, if we were to break above the $110 level, then I think the market is likely to continue going higher, as we had previously. Although the market has been very choppy as of late, it is worth noting that the most recent swing low was higher than the one before it. Now we are trying to simply make a higher high.

If we were to break down below that uptrend line that I just mentioned, then it could open up a move down to the 200 Day EMA, which would attract a lot of attention in and of itself, especially as we would be breaking through the $90 level. The market has been bullish for ages but got far ahead of itself after the Russian invasion of Ukraine. Now that we have digested a lot of those gains, the market seems to be ready to make its next move. I suspect it will be higher, but we need to follow price action as argued what the market makes no sense. The US dollar could have a major influence as well, although it should be noted that both the US dollar and oil can rally at the same time.

[ad_2]