[ad_1]

The EUR/USD exchange rate was unable to escape from the bottom of its recent low and entered the new week’s trading at the risk of further losses. The losses could see the single European currency slide towards some of its lowest levels since the first half of 2017 throughout the year during upcoming days. With the beginning of this week’s trading, the price of the EUR/USD pair moved in a range between the level of 1.0494 and the level of 1.0593 in the same ranges of the last trading sessions.

The Euro’s recovery has been attempted repeatedly last week as well as on Friday before the weekend with data from European Central Bank policy makers indicating that the timing of an initial rate hike in the Eurozone is likely to approach. European Central Bank Governing Council member Francois Villeroy de Gallo said on Friday that Frankfurt could raise the negative deposit rate of -0.5% “to positive territory” by the end of the year, while Executive Board member Isabel Schnabel suggested on Monday that the initial rise It may come as soon as July.

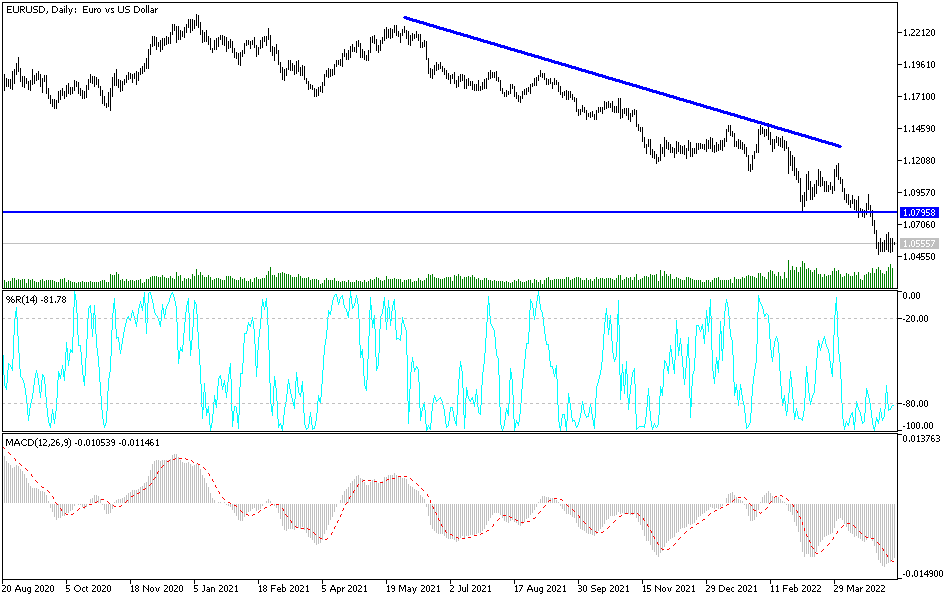

However, the EUR/USD exchange rate was unable to withstand any of its attempts to recover, and it may now be at risk of extending its recent streak of losses with a break below the 1.05 level over the coming days.

Juan Manuel Herrera, strategist at Scotiabank says: “There are few notes on the eurozone calendar over the next two weeks other than speeches from the European Central Bank, but markets seem to be in a safe place for the ECB’s price bets.” He added, “The technical picture for the euro continues to indicate more losses to the 1.04 level, after the consolidation period that lasted seven sessions. The analyst warned that the euro’s trading (mostly confined between 1.05 and 1.06 levels) helped it out of the oversold area on the RSI.

The euro’s ability to recover against the dollar has been hampered by rising US bond yields and economic risks associated with the currently stalled EU push towards a Russian oil embargo, although the single European currency faces other fresh and headwinds this week as well. This comes after it was widely reported that Chinese Prime Minister Li Keqiang called for intensified efforts by the authorities to save jobs and support families, while battling the repercussions of measures to contain the Corona virus in major urban centers, including Shanghai and Beijing.

“The employment situation is deteriorating along with the rest of the economy,” says Craig Botham, chief China economist at Pantheon Macroeconomics. All April PMIs point to high unemployment, despite government promises to support companies affected by the zero-Covid-19 policies.

The deteriorating economic background and the government’s increasing willingness to support Chinese growth pose downside risks to the renminbi and upside risks for the USD/CAD pair, which in turn indicates continued headwinds for many other currencies relative to the US dollar including the euro. To the extent that these factors add more to the baggage around the ankles of the euro against the dollar, it may be enough to see the euro drop below the 1.05 level and towards the 2017 lows around 1.0344 during the opening phase of the week’s trading.

According to the technical analysis of the pair: There is no change in my technical view of the price performance of the EUR/USD currency pair. The general trend is still bearish, and a breach of the 1.0500 support will increase the bears’ control over the trend, and therefore move towards stronger support levels and the closest ones after that 1.0435 and 1.0300, respectively. As mentioned before, continuing weaknesses – divergence in economic performance, the future of central bank policy tightening and the Russo-Ukrainian war support the current trend. On the upside, without breaching the resistance levels 1.0795 and 1.1000, the general trend of the EUR/USD will remain bearish, and the currency pair will be affected today by the announcement of the German ZEW index reading.

Eurodollar Outlook: HSBC cut its forecast last week and now expects the euro to reach $1.03 by the end of June and parity in the first months of next year.

[ad_2]