[ad_1]

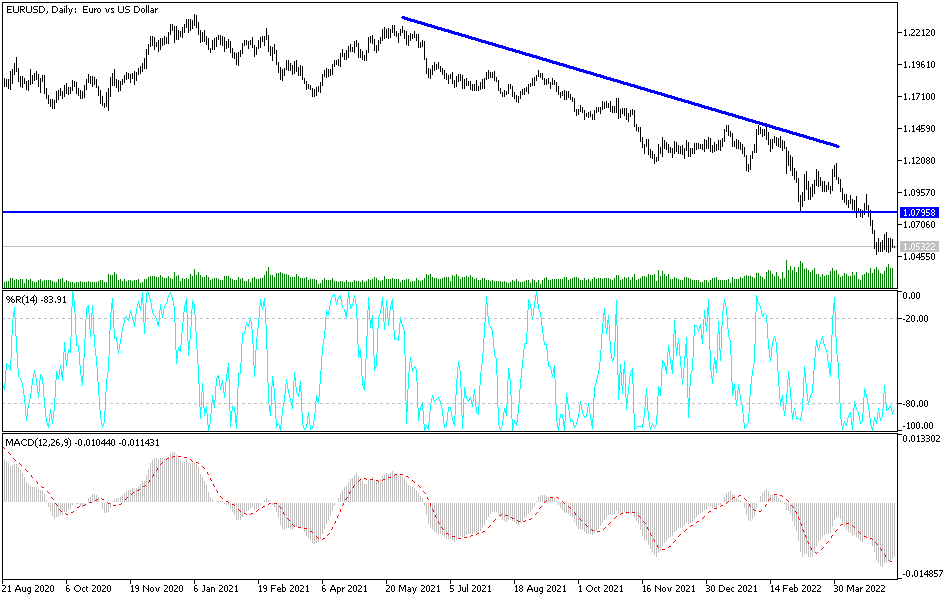

For the second week in a row, the price of the EUR/USD currency pair is moving in narrow ranges. This vicinity warns technically of an upcoming strong move, as the markets absorbed what was announced to raise US interest rates at the largest pace since 2000. The US jobs numbers were announced and today the important US inflation numbers will be announced as well. Euro-dollar losses brought it to the level of 1.0470, the lowest in five years, and attempts to rebound higher did not exceed the 1.0630 level during that period. It is settling around the 1.0526 level at the time of writing the analysis.

The Federal Reserve has said that Russia’s war in Ukraine and rising inflation are now the biggest threats to the global financial system, replacing the coronavirus pandemic. The notes came in the Federal Reserve’s semi-annual Financial Stability Report, which looks at trading and investment trends as well as general economic issues. The report is not an economic forecast, nor does it attempt to predict the following risks to the financial system. It highlights areas of interest to central bankers.

The Fed added that economic uncertainty has increased since the bank’s previous report, with the Ukraine war being a large part of the deterioration. The bank also highlighted significant fluctuations in asset prices – from Treasuries to stocks – as investors reassess risks in a high-inflation environment. “Inflation was higher and more stable than expected, even before the invasion of Ukraine, and uncertainty about inflation expectations poses risks to financial conditions and economic activity,” the Fed added in its report.

The Fed said persistently high inflation could require central banks to raise interest rates quickly, which could also be a potential risk of financial instability in the form of lower economic output as well as higher borrowing costs for individuals and businesses. This could cause debt levels, which the Fed says are high but not yet a major concern, to become unsustainable for some companies.

The US central bank also said, “More negative surprises in inflation and interest rates, especially if accompanied by a decline in economic activity, could negatively affect the financial system.” For individuals, inflation could cause job losses as the Federal Reserve increases interest rates, which could also affect the housing market through higher mortgage rates, the bank said.

The report reflects the Fed’s thinking, its conclusions may be part of the background when the central bank conducts annual stress tests of the nation’s largest banks in the coming weeks. The Federal Reserve has used previous reports to highlight the pandemic as well as last year’s interest in “meme” stocks such as GameStop and AMC Entertainment.

In a statement, Fed Governor Lyle Brainard also cited recent volatility in commodity markets as a place for potential risks. While volatility in the energy market has grabbed the headlines for several weeks now, there have been other commodity markets — particularly those for industrial metals such as nickel, zinc, and lithium — that have seen significant swings.

According to the technical analysis of the pair: Ahead of the announcement of US inflation figures, which affect the course of global financial markets. There is no change in my technical view for the price performance of the EUR/USD currency pair, as the general trend is still bearish. A breach of the 1.0500 support will increase the bears’ control over the trend, thus moving towards stronger support levels and the closest ones after that are 1.0435 and 1.0300, respectively. As I mentioned before, continuing weaknesses – divergence in economic performance, the future of central bank policy tightening and the Russo-Ukrainian war – support the current trend. On the upside, without breaching the resistance levels 1.0795 and 1.1000, the general trend for EUR/USD will remain bearish.

[ad_2]