[ad_1]

I think that a day or two of positivity might be a selling opportunity at the first signs of exhaustion.

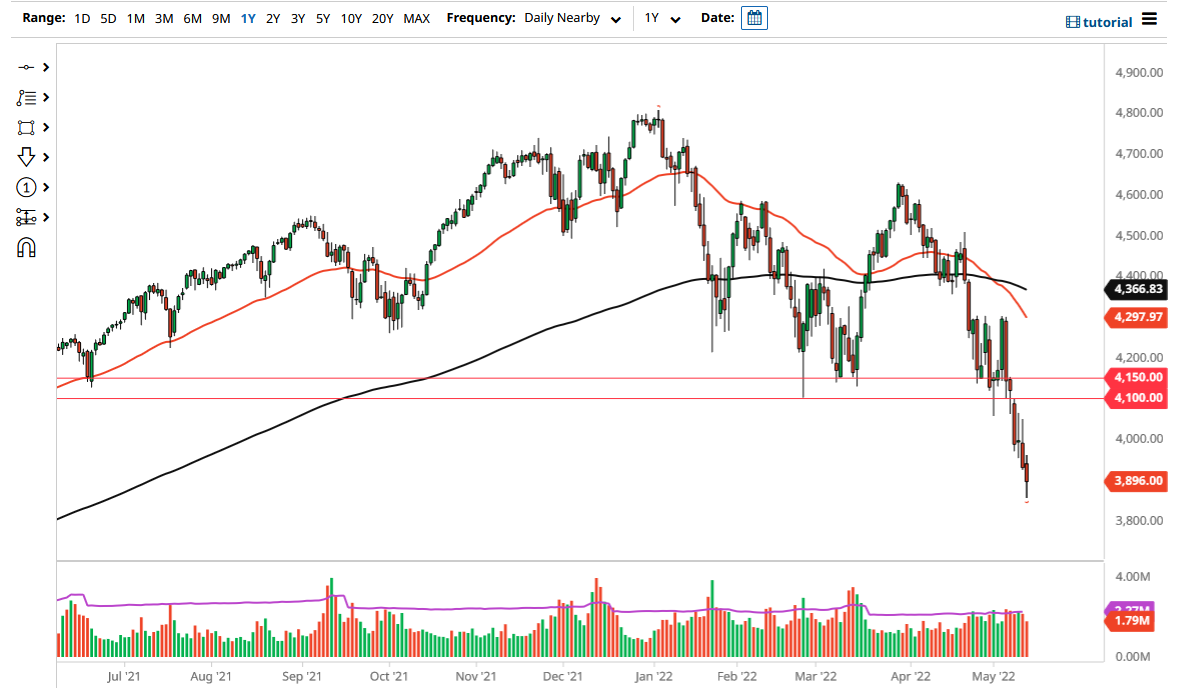

The S&P 500 has broken down rather significantly in the futures market during the trading day on Thursday as we continue to see a lot of “risk-off” behavior around the world. Quite frankly, with the Federal Reserve doing everything that it is set to do, it is difficult to imagine a scenario where we see this market take off to the upside for anything sustainable. The 4000 level has been sliced through like a hot knife through butter, and therefore it tells you just how negative things are at the moment.

If we break down below the bottom of the candlestick for the trading session on Thursday, it opens up the possibility of dropping down to the 3800 level. However, it is probably worth noting that we are a bit oversold at this point, so I do think that it is probably going to be a scenario where we see every rally gets sold eventually. That being said, we are so oversold that it would not surprise me to see some type of short squeeze, but that will offer an opportunity to get negative yet again.

I see the area between 4140 and 4150 as being a major barrier, and it will more likely than not be difficult to take that thing out. If we were to break above there, then it is possible that we could go to the 4300 level above. The 50 Day EMA is sitting right there and dropping, so I think that offers a major barrier. If we were to break above all of that, it is likely that we will eventually see a turnaround. However, unless the Federal Reserve changes its overall attitude, I just do not see how that is going to be the case. Because of this, I think that a day or two of positivity might be a selling opportunity at the first signs of exhaustion.

On the other hand, if we could break down below the bottom of the candlestick for the trading session, then it is likely that we will break down rather significantly. Momentum certainly is to the downside, and therefore it is difficult to imagine how you can fight that. Given enough time, we could probably see continuation as stock markets continue to be very fragile and needless to say, struggle overall.

[ad_2]