[ad_1]

This is a scenario where even if we do rally, it more than likely is going to offer a better place to sell from.

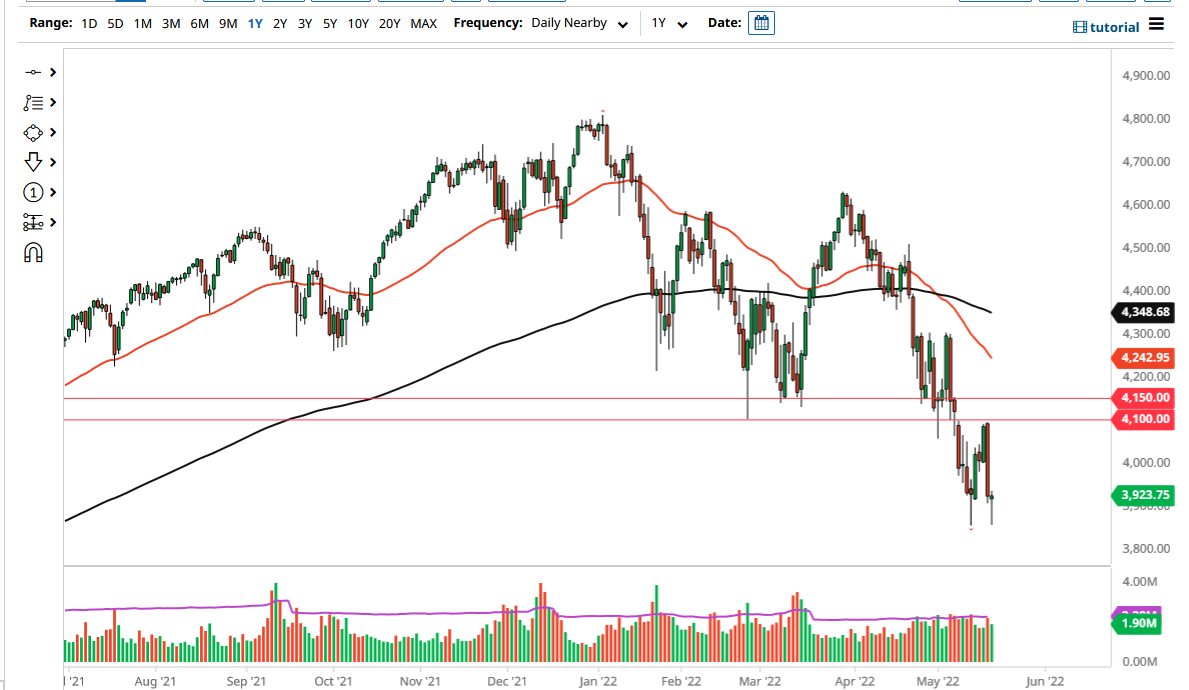

The S&P 500 has fallen hard during the trading session on Thursday but bounced enough to form a bit of a hammer. That being said, there are still a lot of concerns out there in the futures market that may not be indicative of what we are going to see longer-term. I would not call this a “double bottom”, because some of what we are starting to see could be in preparation for the Friday options expiration day.

Obviously, we are in a downtrend and I do not think that has changed regardless of how the day turned out. This is a scenario where even if we do rally, it more than likely is going to offer a better place to sell from. The 4000 level could offer a little bit of psychological resistance, but we have significant structural resistance near the 4100 level. Between 4100 and 4150, I would anticipate a major fight. Breaking above there then opens up the possibility of a move to the 50 Day EMA, but right now it is very difficult to imagine that move unless of course, the Federal Reserve changes its overall tune. The US dollar was overbought, and part of what we may have seen during the day was in reaction to the greenback giving back some of the gains. However, as we got into the clothes things started to get extraordinarily volatile, so I do not trust this at all.

I will be looking for signs of exhaustion after a rally to get short of this market, as the trend is so firmly ensconced in of course there are a multitude of issues facing the stock market. Yes, markets cannot fall forever but quite frankly there is nothing that should send this market higher. As long as the Federal Reserve is hell-bent on fighting inflation, that means that there will be tight monetary policy, which works against the value of stocks on the whole. With this being the case, I believe it is probably only a matter of time before we see more selling pressure, or perhaps some type of capitulation move. We have not seen complete capitulation yet, so I am afraid there is still more ugliness ahead. In fact, I believe that you will have plenty of time to get involved unless of course the Federal Reserve suggests it is going to change its course. With inflation being a strong as it is, we are nowhere near that.

[ad_2]