[ad_1]

Even with US dollar strength being very possible, I just don’t see what would bring this market down anytime soon.

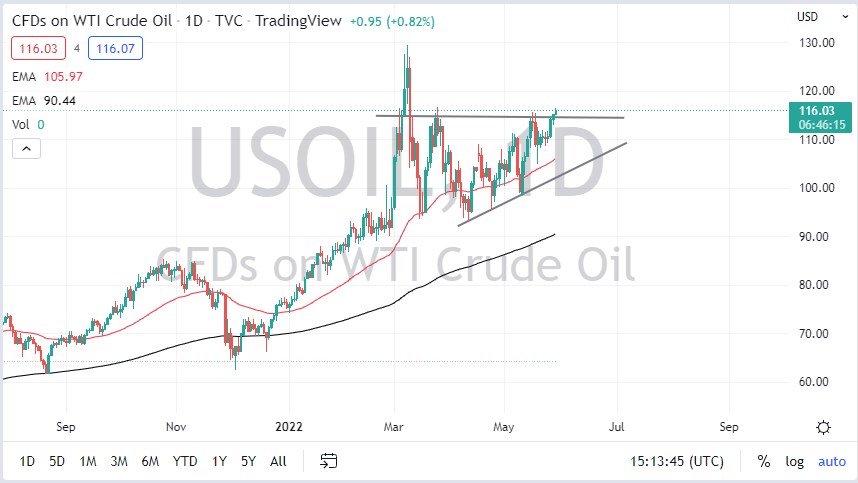

The West Texas Intermediate Crude Oil market rallied a bit on Monday, but it should be noted that volume will have been a bit lighter than usual as it was all after-hour trading as the Americans were celebrating Memorial Day. We are in the process of breaking out of an ascending triangle, suggesting that we are ready to go much higher. At this point, I would anticipate that a break at the highs during the Monday session could open up fresh buying to push WTI to the $120-a-barrel level rather quickly.

Pullbacks should be well supported, especially near the $110 level, assuming that we can even fall that far. Even if we broke down below the $110 level, I believe that the 50-day EMA and the massive uptrend line both come into the picture as well. Ultimately, this is a market that is more or less “buy on the dips”, as there are a lot of concerns when it comes to supply, especially as the Chinese are coming back online after being locked down.

I would point out that the most recent pullback did not dip below the 50-day EMA, unlike the previous three. Because of this, it looks like the buyers are becoming a little bit more aggressive, as sometimes the market will whisper what it wants to do to you. This was a very subtle change in attitude, but now that we are breaking out to the upside above resistance, it becomes abundantly clear that there are plenty of people that are willing to step in and pick up oil anytime they get an opportunity to find value.

As far as selling is concerned, we would need to break down below the bottom of the triangle to make that happen. That is roughly $13 from here, so I don’t see that being an issue anytime soon. Even with US dollar strength being very possible, I just don’t see what would bring this market down anytime soon. I suppose the Russians could leave Ukraine, but that is not very likely either. At this point, this is a one-way trade and should be treated as such. Eventually, I anticipate that we will probably test the highs again with the $120 level offering a bit of noise along the way.

[ad_2]