[ad_1]

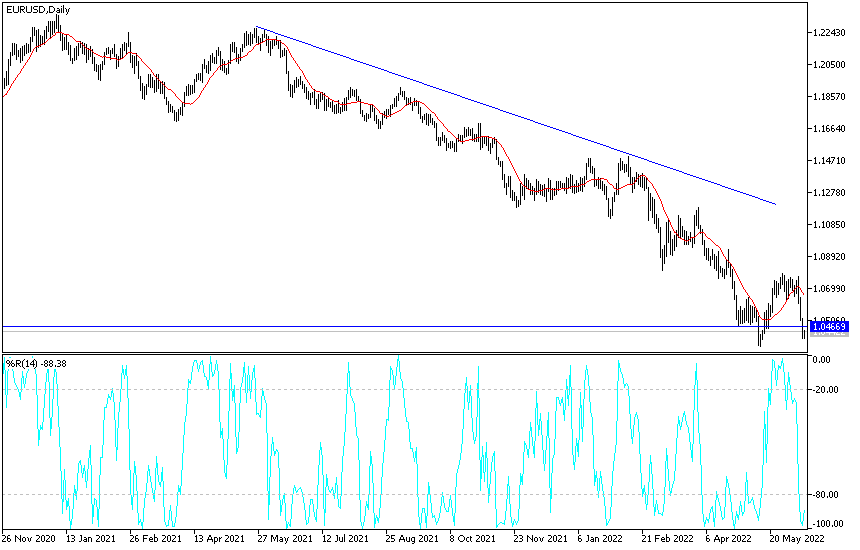

In the same trading path for the past week, the price of the EUR/USD currency pair is moving during this important week’s trading. This is amid strong bearish momentum, which moved on its impact towards the 1.0396 support level. It settled around the 1.0450 level at the time of writing the analysis, before announcing the reading of the ZEW index of German economic confidence. The euro tumbled due to a toxic mix of domestic and international headwinds but will likely remain under pressure in the coming days if US bond yields and the US Federal Reserve’s policy outlook continue to dampen risk appetite.

The currency pair’s struggles increased in the forex market after US inflation figures surprised to the upside expectations for the month of May on Friday and prompted the market to revise its expectations for US interest rates in the coming months. That data lifted US bond yields and dollar exchange rates while fueling an early selloff in global stock markets that weighed heavily on many currencies, although the Euro was also struggling in the wake of last week’s historic European Central Bank decision.

The euro was unable to capitalize when the European Central Bank said last Thursday that it would start raising interest rates in the euro zone in July and that it expects to raise borrowing costs in a sustainable manner over the coming months. Many analysts say this reflects market concerns about higher rates. It means the bond markets in southern Europe. The European Central Bank also announced a plan to use the reinvestment of the €1.85 trillion bond portfolio obtained through the Pandemic Emergency Purchase Program in order to prevent disproportionate and destabilizing increases in financing costs for the most financially fragile eurozone members.

This has done little to prevent markets from expressing their concerns about how southern European economies and bond markets will perform as interest rates rise in the bloc, and these kinds of concerns tend to weigh on the euro, which may now be more likely to strengthen the dollar. Commenting on the outlook, Silvia Ardajna, chief European economist at Barclays, said, “The risk of a repeat of a summer like 2011 has increased as the market may want to find out more about conditions (spread levels and growth velocity) that the ECB may view as weak in monetary policy transmission.”

According to the technical analysis of the pair: The general trend of the EUR/USD pair is to the downside and the breach of the support 1.0400 supports a stronger control of the bears on the trend. Currently, the closest trend targets are the support levels 1.0380 and 1.0290, those levels are sufficient to push the technical indicators towards strong oversold levels from which one can think of buying opportunities. The EUR/USD currency pair may remain under downward pressure until the US Central Bank’s monetary policy decisions are announced tomorrow.

On the upside, the breach of the 1.0600 and 1.0755 resistance levels will have an impact on the bulls’ sentiment for the move.

[ad_2]