[ad_1]

I will probably look at this in a day or two as value, but right now it looks like we still have a little bit of drifting to do.

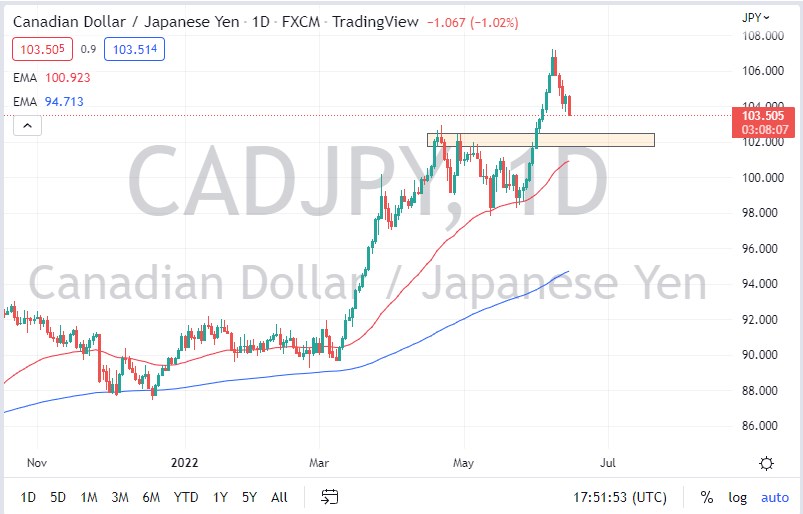

The Canadian dollar fell a bit against the Japanese yen on Wednesday, as the oil markets have also started to correct a bit. Nonetheless, oil should continue to rise over the longer term, so the normal longer-term correlation should come back into the picture. The market is highly sensitive to crude oil as Canada is a major exporter of crude, while the Japanese economy imports 100% of its fuel.

When I look around the world, it’s obvious that there is a lot of concern when it comes to risk appetite, and one would have to assume that the “risk appetite trade” would be buying this pair. However, the Bank of Japan continues to do everything it can to keep interest rates near the 25 basis points area on the 10-year note, so at this point, the Japanese yen will continue to drop in value against most currencies, but no market goes straight up there forever. In fact, a pullback to the box that I have had on this chart for several days makes sense. That would have the market testing the ¥102 level, an area that had been a previous high.

The 50-day EMA is rising toward that same area as well, so I think it does make quite a bit of sense that it all coincides in the same area and we get an opportunity to see buyers jump in. Ultimately, that’s the trade I am looking for, but we will have to see whether or not we get that opportunity. If we do break down below the 50-day EMA, then the next major support level will be found at the psychologically important ¥100 level. Anything below there then starts to threaten the overall trend itself.

That being said, pay attention to the oil market, pay attention to the bond yield differential between the two economies, and of course the overall risk appetite. As long as that’s going to all point toward Canada, then I think it is likely that we will continue the trend, but the occasional pullback from a parabolic move would be expected, just as it would in any other market. I will probably look at this in a day or two as value, but right now it looks like we still have a little bit of drifting to do.

[ad_2]