[ad_1]

This is all about risk appetite at this point, so keep that in mind.

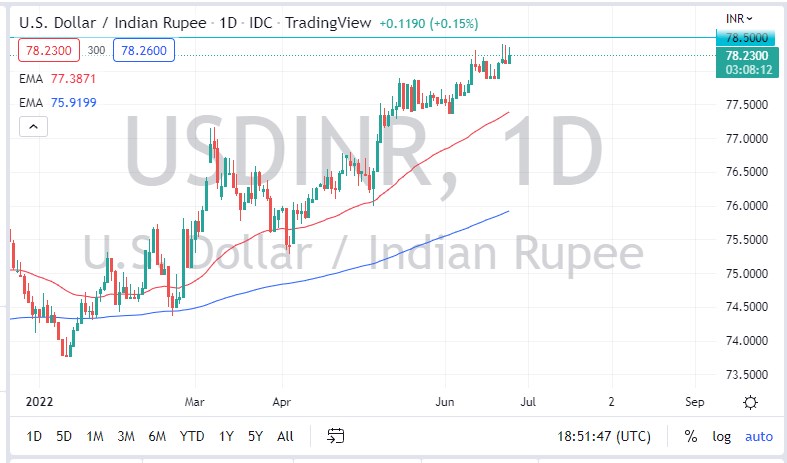

The US dollar rallied on Friday to close out the week against the rupee. Looking at this chart, any time we pull back, it’s likely that we will find plenty of buyers underneath. After all, the market has been in an uptrend for quite some time, and interest rates in the United States continue to climb.

The rupee has been extremely popular lately – don’t miss these interesting opportunities!

Trade Now

Furthermore, you need to worry about emerging markets in general, due to the fact that the global economy slowing down should continue to be disastrous for economies like India. After all, the market continues to see a lot of money running away from more emerging markets beyond India, so that being said the market is likely to continue to see the US dollar gaining against not only the rupee but other emerging market currencies such as the Brazilian real, Mexican peso, and so on.

The ₹77.50 level underneath should be supported, like the 50-day EMA starting to reach that area. Ultimately, I think it is only a matter of time before we see buyers come in and pick things up, and need to look at this chart through the prism of “finding value.” The market will continue to see a lot of support underneath, and it’s not until we break below the 200-day EMA that I would be concerned about the overall uptrend. However, if we did break through that level, then it’s likely that we will see the US dollar will probably be selling off in multiple markets, perhaps not just emerging markets, but at that point I would anticipate that we would see major currencies will continue to be strengthening as well. After all, if traders are willing to buy the Indian rupee, they are most certainly willing to buy the euro and the British pound.

Once we break above the ₹70.50 level, I believe that the USD/INR pair could very well go to the 80.00 level, perhaps even higher than that. If we do get some type of financial issue, via a recession or perhaps even something a little uglier, I expect this market to go much higher, therefore sending the US dollar skyrocketing against less trustworthy currencies such as the rupee and smaller markets like that. This is all about risk appetite at this point, so keep that in mind.

[ad_2]