[ad_1]

The EUR/USD exchange rate has returned to stability above the recently recovered 1.05 level. With the European economic outlook appearing to be bleak, the euro may now struggle to advance beyond 1.06 without an additional pullback for the US dollar, which appeared to falter in its move of the week. At the beginning of this week’s trading, the euro-dollar moved towards the 1.0615 level, and is currently stabilizing around the 1.0570 level. Overall, the single European currency attracted buying bids from the market whenever it approached the 1.05 support or less. Its recovery above this level was largely supported by the weakness of the dollar and the broad-based gains in the stock and bond markets that many analysts attribute to investors’ concerns about the global economy.

This was after Federal Reserve Chairman Jerome Powell asserted in the US Congress last week that it would be difficult for the Fed to bring down US inflation without disrupting the labor market or hurting the economy, leading to a downward revision of market expectations for US interest rates.

Commenting on this, says Chris Turner, global markets analyst at ING Bank. “The current price action is in line with our base scenario of EUR/USD trading in a range during the summer months before taking a modest turn at the end of the year, we believe, the market should shift towards pricing for the start of the Fed’s easing in late 2023. However, the Fed will continue to tighten and the EUR/USD may struggle to sustain gains above 1.0625/40 this week.”

As for the euro, a revised outlook for Fed policy and a pullback for the dollar offset a further decline in the European Central Bank’s interest rate expectations after last Thursday’s S&P Global Purchasing Managers Index surveys, which warned of a bleak outlook for key industries in the European economy. The downturn in Europe’s PMI surveys reversed much of the recovery from losses from the “winter shutdown,” and came at a time when the continent’s largest economy, Germany, faces rising risks linked to reduced gas supplies from Russia.

Derek Halpini, head of research for global markets at MUFG, said: “The final phase of Germany’s plan will include rationing of gas supplies, which will have a more direct impact on economic activity. With Nord Stream flows further affected by the shutdown of regular annual maintenance, a move to Phase 3 appears more likely than not.”

This could have implications for the prospects for ECB monetary tightening. Currently, roughly 160 basis points of tightening are priced in for the year. This is exaggerated but 185 points per second are priced in the US. Ultimately, it seems more likely than otherwise that the Fed will have a pause before the end of the year, but a certain energy shock through higher natural gas prices could unfold soon and could be a catalyst for a new pullback in the EUR/USD.”

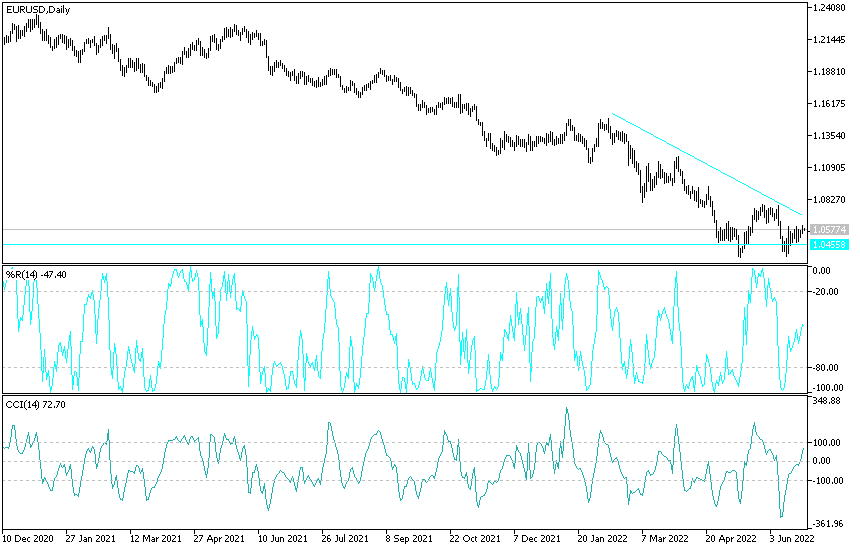

Euro forecast against the dollar:

My technical view of the future of the EUR/USD price has not changed so far, as we have not seen a strong change in the performance of the currency pair since last week. The general trend of the EUR/USD is still bearish and approaching the support 1.0500 supports the bears to move further downwards. Accordingly, the following support levels may be 1.0425 and 1.0380, respectively, and the last and lowest level is moving the technical indicators towards oversold levels.

On the other hand, and as I mentioned before, moving towards the resistance levels 1.0665 and 1.0800 will be important to start breaking the current trend. Today, the euro will await new statements from ECB Governor Lagarde, and the dollar will be on a date with the announcement of US consumer confidence.

[ad_2]