[ad_1]

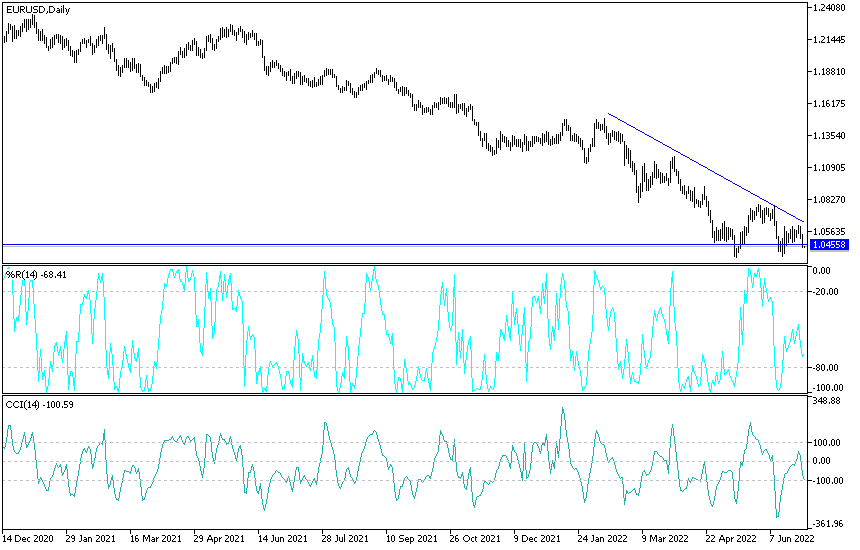

The US dollar returned to its strong upward trajectory amid increasing expectations of the chances of raising US interest rates strongly during 2022. Accordingly, this was a good reason for the EUR/USD pair to decline strongly below the 1.0500 support. As I mentioned before that stability below it will support further collapse to the bottom. The euro’s losses reached the level of 1.0435, which is stable around it in the beginning of trading today, Thursday.

Data from Germany suggests that peak inflation may have passed, lowering eurozone bond yields and euro exchange rates, but there was a partial reversal after Spain’s inflation numbers came in higher than expected. This is an early indication that perhaps the worst of the current inflation spike may have passed and will ease pressure on the European Central Bank to adopt an aggressive rate hike approach.

Commenting on this, Matthias van der Geogt, analyst at KBC Markets says: “European yields and the euro fell after the release of Germany’s first regional CPI reading for June.” It adds to the summer consolidation/correction phase in the bond markets. It also indicates that the EUR/USD could be limited to 1.0350/1.0642 instead of 1.0350/1.08.” “The CPI data for North Rhine-Westphalia (NRW), the most populous federal state in Germany, indicates a much lower reading, which may have been driven by the recent drop in oil prices,” says Tulia Boko, an economist at UniCredit Bank. . And if the NRW data were reversed by other federal states, whose numbers were released later in the morning, the nationwide inflation reading could be only around 7%.

Overall, the European Central Bank is poised to raise interest rates in July and again in September as it grapples with rising inflation, triggering a policy shift that boosted bond yields in the euro zone and provided a floor under the euro. The magnitude and number of spikes received is important to the EUR exchange rates: a 50bp move is seen as a strong commitment to normalization and likely to support the EUR, all else being equal.

But weak inflation readings may encourage a more cautious 25 basis point rate hike, which would disappoint current market expectations for a more aggressive reaction. It may also indicate that the ECB may not make as many rallies over the coming months as the market had been expecting.

Indeed, prior to the data release, markets were pricing as high as 30 basis points from the gains for July, indicating that the prospects for a 50 basis point lift were on edge. As of June 13, the market was expecting a peak in the ECB deposit rate at 2.48%, but it has since fallen back to 2.04% as of June 27 and we expect the latest reading to be lower.

Taming rate hike expectations will trigger a mechanical bearish response in the Euro, as seen in midweek trading. However, don’t expect a complete capitulation for the Euro just yet: Spanish CPI inflation was released hours after German numbers were released higher than expected. The annual figure for May came in at 10.2%, higher than the expected 9.0% and previously announced 8.7%. This is more reactionary than the NRW data in time, but nevertheless the ECB must ensure that its current course is maintained.

EUR/USD forecast today:

Bears control over the EUR/USD pair increased by surpassing the support level of 1.0500 as mentioned in the recent technical analyzes. Currently the closest support levels for the pair are 1.0420 and 1.0380, and from the last level, the technical indicators will move towards oversold levels. The most appropriate resistance levels for the rebound will be above 1.0620 and 1.0800, respectively. The Euro is awaiting the release of German unemployment data and the unemployment rate in the Eurozone. The US dollar is on a date with the announcement of the reading of the personal consumption expenditures price index, the average income and spending of the American citizen, and the weekly jobless claims.

[ad_2]