[ad_1]

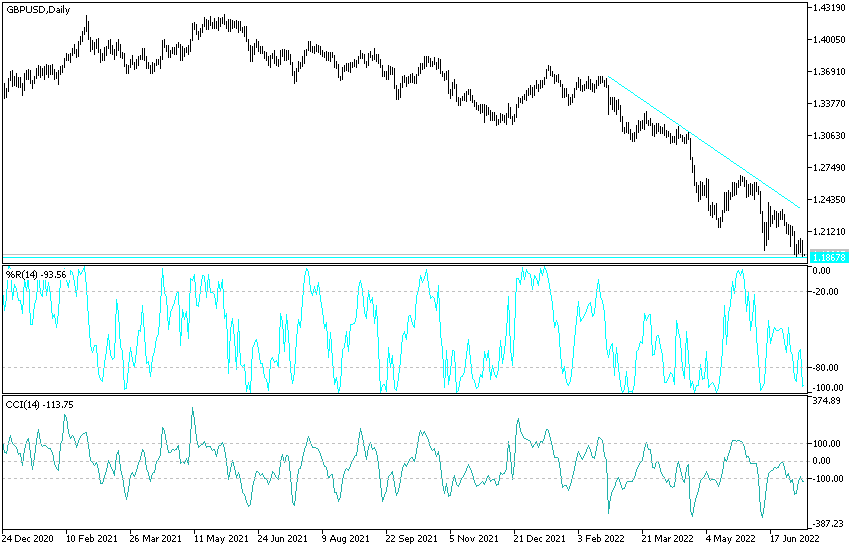

The GBP/USD currency pair tried to maintain the resistance level of 1.20 but faced a battle to hold on to it in the coming days as it will be at risk of sliding towards the stronger support 1.18 and may face difficulties in extending any further advance far above the 1.21 level. Since the start of this week’s trading, the GBP/USD price continued its strongest downward path until it reached the 1.1845 support level, the lowest for the currency pair since the markets collapsed at the height of the global epidemic.

The pound was subjected to many weakness factors, most notably the expectations of the future of economic stagnation, in addition to the negative developments in British political life, which culminated in the announcement of British Prime Minister Boris Johnson.

Commenting on the performance, Lee Hardman, currency analyst at MUFG, says, “We should not assume that political developments are the dominant driver of the pound in the forex markets. Many other factors are likely to be more important in the future.” “We maintain a bearish view for the GBP and in the possible scenario of a breakout in the EUR/USD pair soon, the GBP/USD is likely to extend to new lows beyond the 1.1876 low recorded recently,” the analyst warned.

However, it is noteworthy for the price of the pound against the dollar that, despite its new highs, the US currency was not able to maintain the long periods of erratic strength that still characterize its eruption into several new years, if not several decades. Gains against many major currencies. Mazen Issa, Senior FX Analyst at TD Securities said, “The strong jobs report that beats consensus provides a reminder that the US remains on a flat footing. While a recession is a possibility, the timing may be far from the market.”

“The US dollar has weakened on the back of the euro collapse, so some squaring may see some slight delay,” the analyst added. But we think this is short-lived given the upcoming CPI and CIE numbers. Without the positive compensation of the euro, the dollar remains the king of foreign exchange.”

The dollar didn’t make much of a short rally that followed Friday’s announcement when the US June non-farm payrolls report came out much stronger than expected in the market, in the process reiterating the suggestion of other US economic numbers released last week.

While the US Dollar Index rose during the Asian trading session on Friday, it made little progress compared to the previous gains and actually stalled in the wake of the ISM Services PMI announcement. As this fell less than expected by the market and was one of several recent indications that the US economy may be on a firmer footing than what the market has recently given it credit for, which could mean that concerns are widely prevalent about an escalation of US recession risks have arrived.

That would be supportive of the pound and more so if the dollar is unable to benefit from Wednesday’s US inflation data, which cannot be ruled out as it also did not benefit when Atlanta Fed President Rafael Bostic told CNBC News that interest rates need to rise. More than previously thought. He has so far been among the more moderate members of the FOMC, but Friday’s comments put him in closer alliance with Christopher Waller and James Bullard who recently called for the Fed to raise rates to 2.5% in July and 3%. in September.

US inflation data on Wednesday is the highlight for the dollar this week, but the first-quarter GDP data from China on Thursday may affect risk appetite in the market and many currencies, while on the other side of the sterling equation, the interest of the pound will be on a speech On Tuesday from Bank of England Governor Andrew Bailey. The governor is scheduled to speak at the Official Monetary Institutions Forum (OMFIF) event which he will follow on Wednesday with the release of GDP data for May, which could help the pound if it shows the economy is better standing under the weight of stressful energy prices. It was expected.

GBP/USD Forecast

The price of the GBP/USD currency pair remaining below the psychological support level of 1.2000 will continue to support the bears to move further downwards, indifferent to the arrival of technical indicators towards oversold levels after the recent selling operations. The factors of sterling’s weakness are strong and persistent. In contrast, the US dollar is still reaping gains in demand for it as a safe haven, in addition to strong expectations for the future of raising US interest rates throughout the year. The closest bear targets for the GBP/USD pair are the support levels 1.1820, 1.1755 and 1.1600, respectively.

On the other hand, according to the performance on the daily chart, the GBP/USD pair needs to break the resistance levels 1.2125 and 1.2400 to break the current downtrend. The currency pair is not awaiting significant British and US economic data today.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]