[ad_1]

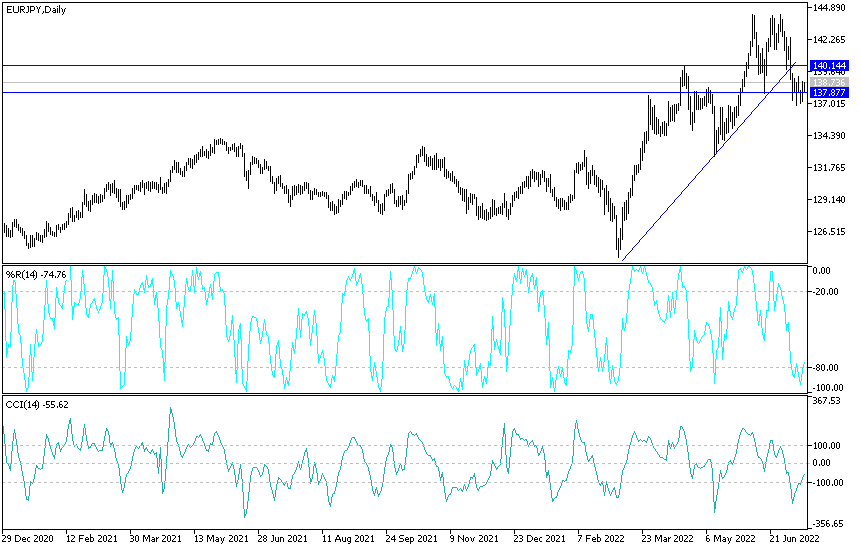

For the second day in a row, the price of the EUR/JPY currency pair is moving in an upward rebound range with gains to the resistance level 139.05. The move was a recovery from selling operations that pushed it towards the support level 136.86. The rebound came amid new operations for the Japanese yen. The euro is still under pressure from expectations of economic recession due to fears of a total cut of Russian gas to the bloc. Therefore, I still prefer to sell the EURJPY from every bullish level.

The closest resistance levels for EUR/JPY are currently 140.00, 140.85 and 143.00, respectively.

On the other hand, the impasse over how to describe the economic repercussions of the Russian invasion of Ukraine hangs over prospects for an agreement and related issues as finance chiefs meet at the G-20 meetings in Bali. The war complicates efforts to settle a statement at the end of the rally on Saturday.

However, Indonesia is pushing for a statement while working on a draft, but host country officials are not optimistic about its prospects and may resort to the president’s statement summarizing the talks at its conclusion, according to one of the officials. Finance ministers and central bank governors from the world’s largest economies will meet under increasingly fragile global conditions, as officials desperately try to tackle inflation and avert recession. Meanwhile, low-income countries are staring at a growing risk of sovereign debt default and social unrest that could lead to widespread destabilization.

Global finance chiefs head to Bali to talk about inflation, debt and oil.

Russia’s participation in the meetings was a fault line that host country Indonesia tried to walk cautiously as it tried to piece together productive discussions on topics such as digital banking and inclusion, climate risk mitigation, and common tax standards.

On the other hand, the euro pairs in the Forex market will be on an important date in the coming days, as the European Central Bank meeting coincides with the timing of whether or not the return of Russian gas will be pumped into an important pipeline to Germany. This comes amid German fears that Russia will refrain from pumping after the end of the periodic maintenance and that it has already happened. The euro will collapse quickly even if the European Central Bank raises interest as expected.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]