[ad_1]

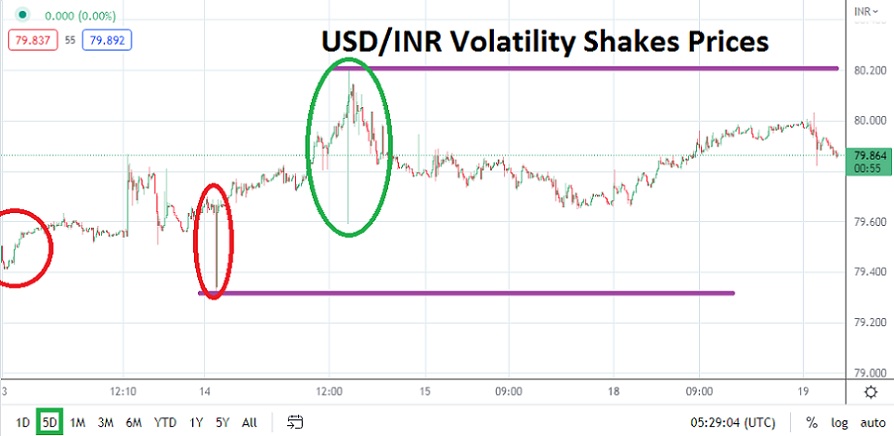

The USD/INR produced another move higher in early trading this morning, and toppled the 80.0000 level once again, then reversed lower with an almost predictable trait.

The USD/INR is trading near the 79.8900 vicinity as of this morning, but traders are advised to check on the price of the currency pair as they read this article to compare differentials. The USD/INR continues to move at a rapid pace and risk tactics need to be incorporated into every facet of its speculative wagers. While the USD/INR flirts with all-time record highs the volatility ripping through its trading is rather predictable as reversals are also being displayed.

The rupee has been extremely popular lately – don’t miss these interesting opportunities!

Trade Now

Ability to Trample Above 80.0000 in USD/INR may Attract More Buyers

While some traders may believe the apex above the 80.0000 is a reason to suspect the upwards ability of the USD/INR currency pair will soon run out of power, a question may arise asking ‘why bet against the trend’? In the middle of last week, the USD/INR also climbed above the 80.0000 mark and in fact climbed to a high of nearly 80.2000 in the blink of an eye. Lightning quick value changes are certainly part of the trading landscape for the USD/INR, and traders are urged use entry point orders to engage.

Third Time may be the Charm if the USD/INR is able to break above Key Psychological Value

The 79.9400 to 79.9600 region should be watched carefully in the short term. If the USD/INR currency pair climbs above this resistance juncture and is able to sustain the value, it may attract additional buyers. Having toppled the 80.0000 ratio twice in the past handful of days, another push above this level may be the impetus needed psychologically to maintain values. The long term bullish trend of the USD/INR may eventually reverse, but it doesn’t appear ready to start a bearish trajectory for a durable timeframe quite yet.

- Maintaining highs above 80.0000 have proven difficult, but another move higher could be sustained next time.

- Risk management crucial as the USD/INR flirts with record highs and suffers volatility.

Cautious traders who are worried about buying the USD/INR at such high levels may want to wait for support regions to be flirted with before pursuing long positions. Short term traders need to use risk management wisely, including stop loss and take profit orders wisely. Traders who are wagering on more upside cannot be blamed for their perceptions, but they should keep their target prices realistic to cash in profits before they vanish because of quick reversals lower. If the USD/INR does break above 80.0000 again in the near term, the forex pair may have more room to explore higher.

USD/INR Short-Term Outlook

Current Resistance: 79.9400

Current Support: 79.8000

High Target: 80.1100

Low Target: 79.6300

[ad_2]