[ad_1]

In recent technical analyses, it was mentioned that the gains of the euro currency pair against the dollar EUR/USD may be subject to sale at any time. This is because the energy future in Europe is still under threat, in addition to the clear contrast between the United States of America and the euro area in the economic performance and the future of monetary policy tightening. After the Eurodollar’s gains towards the resistance level 1.0293, it retreated to the vicinity of the support 1.0150 today.

Goldman Sachs lowered its forecast for the EUR/USD, citing a challenging winter for the Eurozone economy which they now expect to slip into recession. The forecast comes as the euro recovers from its July entry below $1.00, but it would be too early to believe that a major recovery is forming now, analysts say.

“The next six months seem likely to be tough for the eurozone, which is likely to keep EUR/USD close to parity,” says Zach Bundle, Goldman Sachs FX Analyst. The forecast comes alongside Goldman Sachs economists’ predictions that the Eurozone economy will fall into recession in the second half of the year. Accordingly, Bundel added: “The recent move in the EUR/USD pair reflects the changing growth outlook, and is likely to extend somewhat further than that.”

What is Driving EUR/USD Decline?

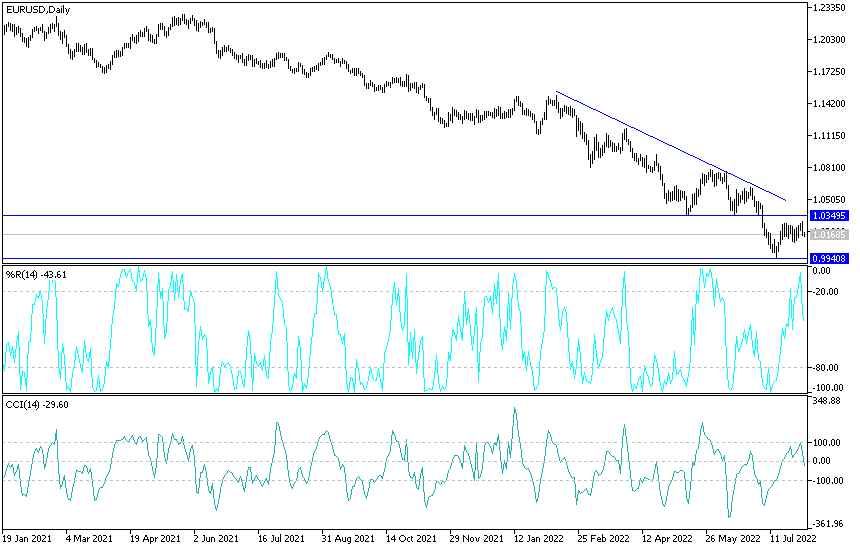

The EUR/USD exchange rate has been declining since May 2021 when it peaked at 1.2254. The currency pair has trended steadily lower since then, reaching as low as 0.9952 in July 2022 before recovering somewhat to 1.0233 where we find it today. “The recent recovery in EUR/USD is not fully justified by the news flow and the market still has some work to do to price our new fundamental outlook,” the analyst added.

It is widely accepted that a list of major drivers has been driving the decline in the euro exchange rates in recent months. The dollar started a cyclical rally in May 2021 as the markets started to raise the level of the Fed that would start exiting QE and eventually raise interest rates.

The depletion of dollar liquidity associated with such moves supports the dollar.

Meanwhile, the European Central Bank’s reticence to raise interest rates despite rising inflation means that the yield paid on US bonds and other monetary assets is much higher than that paid to investors with equivalent assets in the eurozone. Although the European Central Bank has raised interest rates, the difference with the US is still stark.

The latest point of the euro’s weakness has been due to the war in Ukraine and the associated high energy prices, which have greatly affected the eurozone’s economic production potential and consumer health. Wall Street economists say energy demand will have to be dramatically reduced by a combination of high prices and government policies if the eurozone is to get through the winter, even if its storage tanks are full.

Meanwhile, commodity analysts at Goldman Sachs warned that weather-related uncertainty will rise particularly in the first half of winter. A symptom of the energy challenges facing the Eurozone is the surge in prices for base-load electricity in Germany for one year on Tuesday, August 2nd. Prices have risen to over €400 per megawatt-hour for the first time ever. For context, the current rate is about 1,000% higher than the 2010-2020 average of €41.1/MWh.

Euro forecast against the dollar:

According to the performance on the daily chart, if the EUR/USD price settles below the 1.0110 support level, the bears will move strongly to the parity price or below it. The pressure factors on the euro are still continuing and increasing. After the current performance, the technical indicators changed their direction to the downside. On the other hand, the bulls should move towards the resistance levels at 1.0330 and 1.0400 to be the opportunity for a stronger upward shift.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]