[ad_1]

At the beginning of last week’s trading, the bulls tried to control the direction of the EUR/USD currency pair, but the pace of gains stopped at the resistance level 1.0293. It was subjected to selling after that, in anticipation of the announcement of the US job numbers. The pair reached the support level at 1.0141 after strong numbers for US jobs that will support the path of tightening the policy of the US Federal Reserve. We closed the week’s trading stable around the level of 1.0177. It may continue the downward trajectory this week if expectations of a US interest rate hike increase following Friday’s data.

EUR/USD Fundamental Analysis:

The EUR/USD is trading as the US non-farm payrolls for July exceeded the expected number of jobs at 250K, with a total increase of 528K. On the other hand, the US unemployment rate fell slightly to 3.5% from 3.6% and better than market expectations of 3.6%.

Average hourly wages for the month grew 5.2% from the same month last year, topping the consensus estimate of 4.9%. The growth rate (MoM) of 0.5% was also higher than the 0.3% forecast. Earlier in the week, initial US jobless claims came in last week at 260K, slightly above estimates of 259K, while the previous week’s continuing claims lost 1.37M with 1.416M.

From the EU, retail sales for June missed both expectations (monthly) and (annualized) at 0% and -1.7% respectively with -1.2% and -3.7%.

In general, the US dollar rose against the British pound, the euro and other major currencies after the US Bureau of Labor Statistics said that the increase in jobs led to a decrease in the unemployment rate in the country to 3.5% from 3.6%. The strong numbers will justify the claim of US officials that the US economy is not in a recession, despite printing two negative quarters of growth in the first and second quarters.

Treasury Secretary Janet Yellen said in a recent media appearance: “We have a very strong labor market. When you create close to 400,000 jobs a month, it’s not a recession.” The jobs data will support expectations that the Fed will continue its policy of pursuing aggressive rate hikes, which in turn supports the dollar.

For his part, says Christoph Balz, chief economist at Commerzbank. Fed Chair Powell told reporters following the interest rate hike in July that he would monitor the two employment reports scheduled before the September meeting. “It will help determine whether the Fed should continue to apply the brakes aggressively,” he added. The first two of these data points have now been published – and it shows the labor market is still hot,” and “calls for a rate hike are likely to rise another 75 basis points at the FOMC.”

EURUSD Technical Analysis:

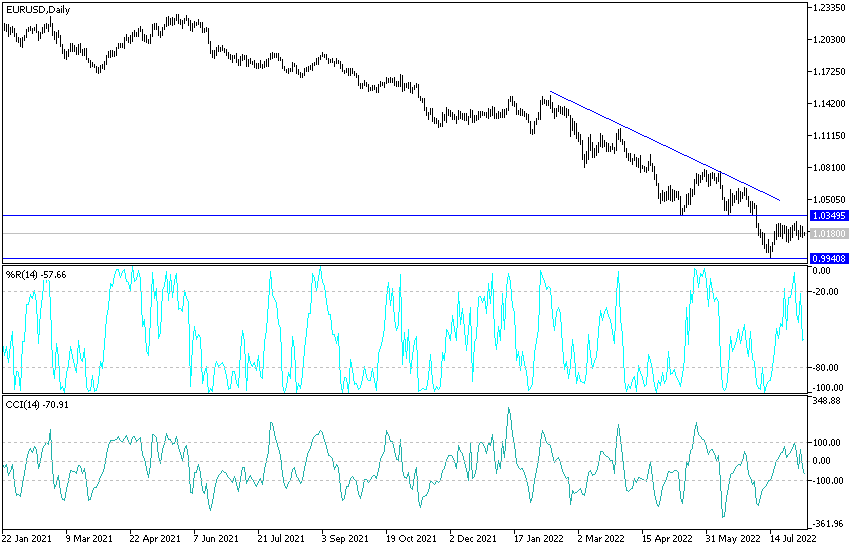

In the near term and according to the performance on the hourly chart, it appears that the EUR/USD is trading within a choppy neutral channel formation. This indicates a fierce battle between bulls and bears. Therefore, the bulls will target short-term rebound profits at around 1.0205 or higher at 1.0236. On the other hand, the bears are looking to extend declines towards 1.0142 or lower to 1.0110.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current downside move towards the 1.0004 support or lower to 0.9815. On the other hand, the bulls will target long-term profits at around 1.0345 or higher at 1.0534.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]