[ad_1]

Fading short-term rallies will be my plan.

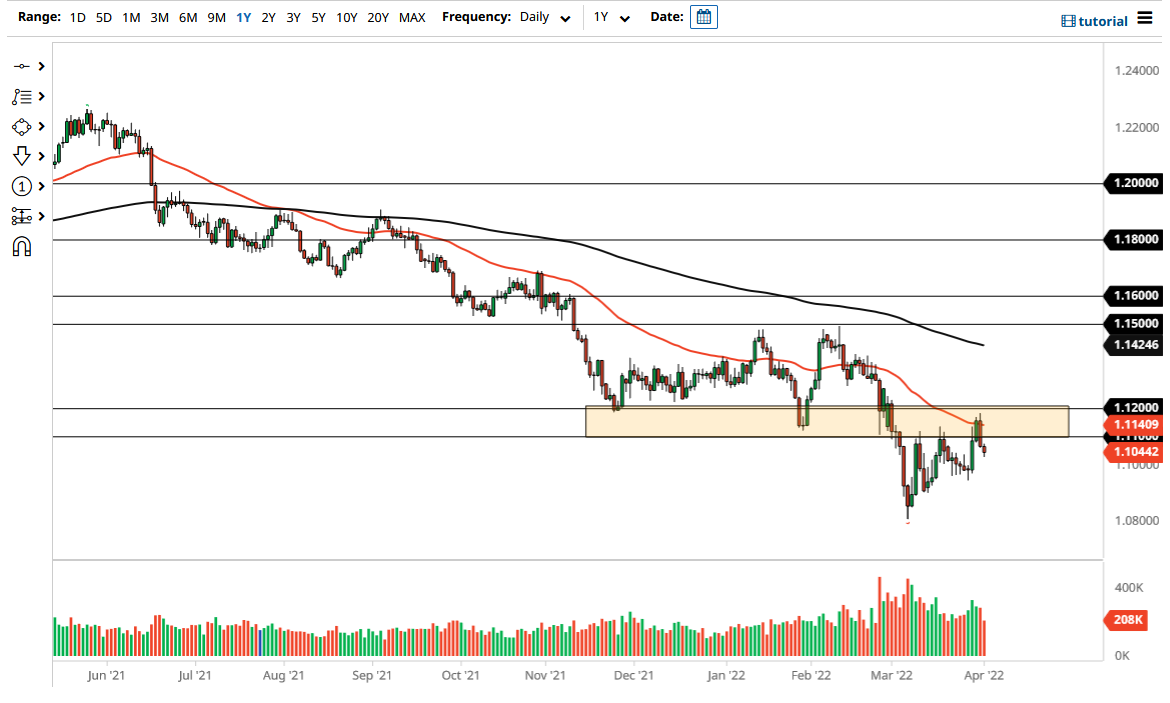

The euro has fallen a bit on Friday to break below the 1.1050 level, which suggests that we are ready to go to the 1.10 level after that. This is an area that has been important more than once, so it is interesting to see that we are probing into it. This is a market that has been in a downtrend for quite some time, and it is worth noting that the 50 Day EMA had offered quite a bit of resistance when we got to that level over the past couple of sessions.

We are very much in a downtrend, and it should continue to be so, so if we were to break down below the Tuesday candlestick, then I think the market will unwind and go looking to the 1.0850 level eventually. That is an area that I think will attract a lot of attention because there is significant support underneath there on historical charts.

Pay close attention to the fact that the market has been focusing on interest rate differentials between the United States and Germany, as they continue to widen. As long as interest rates in America are so much higher, it makes the US dollar much more attractive than the euro. Furthermore, the Germans have just recently had to bring down their GDP estimates, and quite drastically at that. This suggests that the European Union is going to continue to struggle, and therefore it is likely that we will continue to see negativity here.

If we were to turn around and break above the 1.12 handle, then it is worth noting that a major resistance barrier has been slashed through. At that point, the market would more than likely go looking to the 200 Day EMA, perhaps even the 1.15 level after that. That obviously would take some type of good news coming out of the European Union, or perhaps the Federal Reserve walking back its hawkish stance, but right now it still looks as if it is going to have to fight inflation, meaning a tightening monetary policy. With this, I think you should continue to fade rallies, but as per usual, this is a market that continues to see a lot of choppy behavior, which is the hallmark of the euro itself. Fading short-term rallies will be my plan.

[ad_2]