[ad_1]

Gold futures extended their gains since the start of trading this week. Gold prices were the closest to testing the psychological top of 1800 dollars an ounce. The price of the yellow metal moved towards the resistance of $ 1788 an ounce before settling around the level of $ 1765 an ounce at the time of writing the analysis. The gains in the gold market came amid a weak US dollar and lower Treasury yields. However, with the US Federal Reserve expected to ease its tightening efforts, investors are once again flocking to gold and investors are covering their shorts.

All in all, the price of gold is up about 5% over the past week, but it’s still down about 2% since the start of 2022 to date. At the same time, the price of silver, the sister commodity of gold, is taking a breather. Silver futures fell to $20.29 an ounce. The price of the white metal is also up about 8% over the past week, although it has remained down about 12% so far this year.

What do gold’s gains mean?

The price of the yellow metal tried to record its fifth win in a row, which is the best performance since April. Surprisingly, things are not just about the economy that underpins gold’s gains. Commenting on the performance, Ravi Boyadjian, chief investment analyst at XM, wrote: “Risk sentiment took a big hit on Tuesday as it emerged that US House Speaker Nancy Pelosi was on her way to Taiwan, defying China’s strong advice not to visit the disputed region.”

This has alarmed global financial markets as it may reduce the bilateral relationship between Beijing and Washington.

The gains were likely to be capped by a stronger dollar. The US dollar index (DXY), which measures the performance of the US currency against a basket of currencies, rose 0.5% to 105.97, from an opening at 105.45. A stronger profit value is usually a bad thing for dollar-priced commodities because it makes them more expensive to buy for foreign investors. Another factor affecting the gold market was the treasury bond market mixed in performance, with the 10-year bond yield rising two basis points to 2.625%. The spread between the 2- and 10-year notes has widened to -35 basis points. Higher bond yields increase the opportunity cost of holding non-yielding bullion.

In other metals markets, copper futures fell to 3.507 dollars a pound. Platinum futures rose to $905.50 an ounce. Palladium futures fell to $2,149.50 an ounce.

Overall, the price of gold rose to its highest level since early July as investors braced for a stormy period in US-China relations with House Speaker Nancy Pelosi heading to Taiwan. The precious metal often benefits from bouts of geopolitical turmoil, and Pelosi’s trip adds to the tailwinds that helped gold rebound from its 15-month low. The reversal of the rising dollar and growing concerns about the global economy also helped bullion prices.

Today’s XAU/USD Gold Price Forecast:

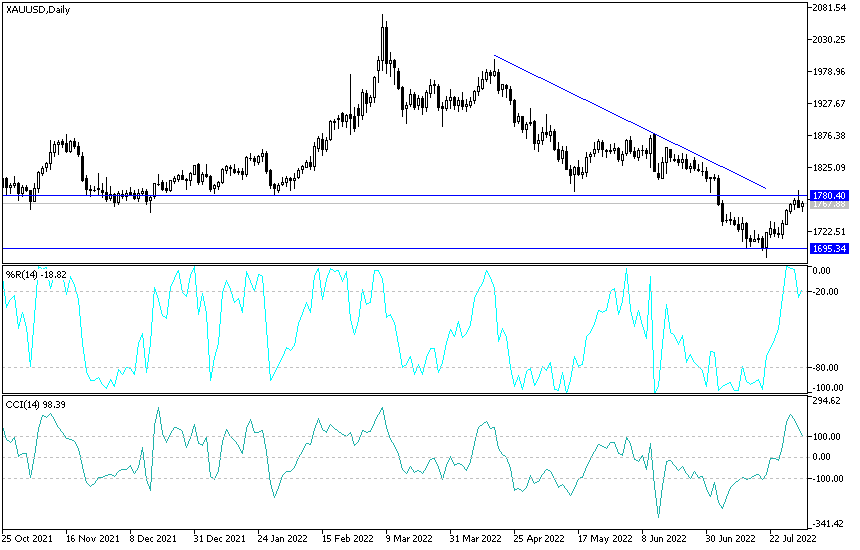

So far, bulls’ attempts to control the price of XAU/USD are still valid, and stability above the $1,780 resistance is important to anticipate the next psychological top $1,800 an ounce. Skipping it will increase the technical purchases of gold and complete the bullish rebound. The price of gold may witness some relative stability until the US jobs numbers are announced by the end of the week. Gold can be bought from every descending level, and the closest support levels for gold are currently 1758 and 1740 dollars, respectively.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold brokers worth trading with.

[ad_2]