[ad_1]

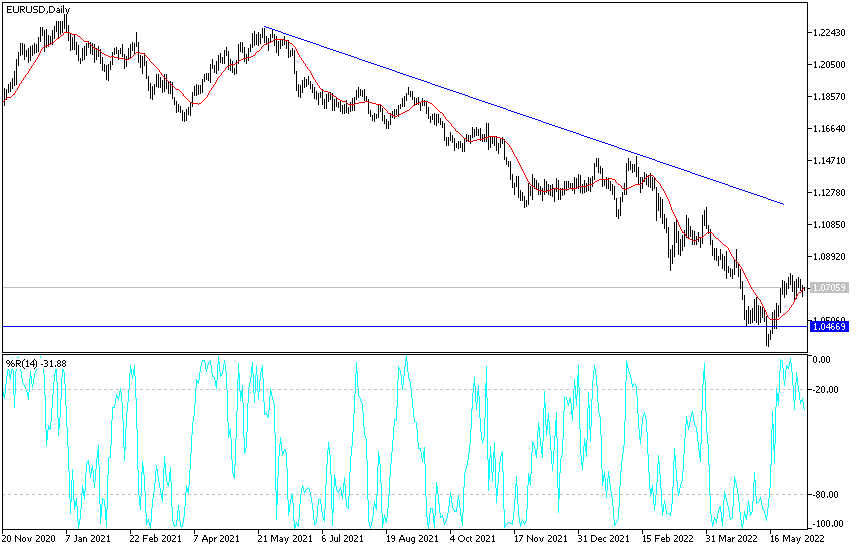

A state of instability dominates the performance of the EUR/USD currency pair since the start of trading this week. The performance may remain so until the announcement of the monetary policy update of the European Central Bank, and then finally the US inflation figures, which have a strong reaction to expectations of tightening Federal Reserve policy. Recently, the US job numbers came in support of the path of raising US interest rates strongly during 2022. The price of the euro dollar is settling between the support level at 1.0652 and the resistance level at 1.0752, and it is settling around the level of 1.0705 at the time of writing the analysis.

Financial market bets have cut halfway towards calling for a historic half point rate hike by the European Central Bank as soon as July. Investors priced 37.5 basis points into the ECB’s tightening rate by next month’s meeting, suggesting there is a 50% chance of a half percentage point increase, which would be the first since 2000. That rise was already achieved by September, assuming the deposit rate remains flat on Thursday, with a 134 basis point rate hike expected by the end of the year. It is a far cry from the start of the year when inflation was expected to be temporary, and investors were betting on just 15 basis points of tightening this year.

The European Central Bank came under tremendous pressure after inflation in the region extended to a record high in May, climbing to more than four times the central bank’s 2% target. While ECB officials have long indicated that a quarter-point increase is coming, some Governing Council members have suggested that a larger increase is possible. On Wednesday, Robert Holzmann said record high inflation strengthens the case for a half-point hike in July, which will also support the euro exchange rate.

Sensing the urgency, analysts at Bank of America last week forecast that the European Central Bank will raise interest rates by half a point in July and September, followed by two quarter point increases in the last two policy meetings of the year.

According to the technical analysis of the pair: Do not change my technical view of the currency pair. The discrepancy between the future of raising interest rates from the Federal Reserve and the European Central Bank will remain a negative influence on any gains for the EUR/USD pair, not to mention the continuation of the Russian-Ukrainian war and its negative repercussions on the Eurozone. To turn the general trend of the EUR/USD to the upside, the bulls broke through the resistance levels 1.0795 and 1.1000, respectively.

On the downside, if the bears move towards the support levels 1.0625 and 1.0540, the bullish expectations will be affected, and the bearish look will return again. The euro will be affected today by the announcement of the growth rate of the euro zone, and the absence of the economic calendar from important and influential US economic data.

[ad_2]