[ad_1]

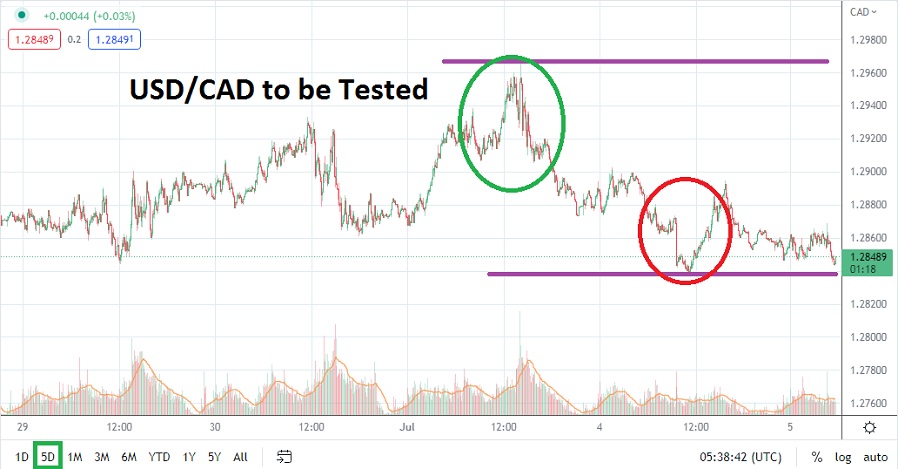

The USD/CAD has come off of highs and is bouncing along important mid-term support levels in early trading this morning.

After nearly hitting the 1.29670 ratio on the 1st of July and threatening to test higher values seen via a one month technical chart, the USD/CAD has reversed lower. As of this writing the Forex pair is near the 1.28450 mark, and earlier this morning flirted with lows displayed yesterday around the 1.28380 level. Technically the USD/CAD is hovering near important mid-term support, and if there is enough selling pressure the 1.28180 could find it is challenged.

Compared to many of the other major currencies the Canadian Dollar has done better against the USD since November of 2021. Yes, the USD/CAD has climbed upward from its mark of 1.22850 which was seen in October of 2021, but the move higher has been choppy and filled with volatile trading. Speculators of the USD/CAD technically can certainly follow trends, but they need to acknowledge the rides up and down sometimes look like a series of rather steep ski slopes.

A major behavioral sentiment consideration today is the fact U.S financial institutions started disappearing from the trading landscape last Friday, as their employees escaped for a long holiday weekend. The past couple of trading days have seen the USD/CAD sold in a healthy fashion, but can its results be trusted? Will the return of full volume today and tomorrow alter the direction of the USD/CAD as equilibrium is found? Conservative traders may want to watch the first few hours of trading this afternoon to get a better feel for the direction of the USD/CAD via their technical perspectives.

While many traders may believe the USD/CAD has been overbought the past handful of months, finding the precise time when a meaningful move lower is going to happen remains difficult. Intriguingly as the USD/CAD comes within eyesight of the key support level of 1.28180, which was last seen on the 28th of June traders may become instinctively bearish. If this price level falters the USD/CAD could aim for the 1.27930 value last seen on 13th of June, which was two days ahead of the U.S Federal Reserve’s official rate hike.

Caution may prove to be a good policy today for speculators. The bullish trend of the USD/CAD certainly still exists, even though support levels are momentarily being challenged. If the USD/CAD should start to move higher upon the return of U.S financial institutions, it could signify that resistance levels will start to become vulnerable and price action may touch higher values near term.

Canadian Dollar Short-Term Outlook

Current Resistance: 1.28690

Current Support: 1.28350

High Target: 1.29130

Low Target: 1.28030

[ad_2]