[ad_1]

For two consecutive weeks, the EUR/JPY currency pair was subjected to selling due to concern about the future recession of the Eurozone economy. This came at a time when the European Central Bank accepted for the first time to raise interest rates in many years. Selling losses pushed the EUR/JPY towards the 136.86 support level, and it settled around the 138.50 level in the beginning of this week’s trading.

The yen is a popular asset during turbulent times.

In the recent period, there has been a torrent of statements by European Central policy officials commenting on the future of raising interest rates and their amount, and the reaction to doing so, especially as the eurozone faces an inevitable recession due to the continuation of the Russian-Ukrainian war. European Central Bank Governing Council member Yanis Stournaras said a new tool to keep debt market turmoil at bay, as there may be no need to use higher interest rates if they are strong enough to convince investors not to test them.

In an interview with Bloomberg TV on Saturday in Aix-en-Provence, France, Stournaras said there was a “very good discussion” going on about the tool, expressing confidence in a “consensual and effective solution” and hoping it would surprise markets “on the positive side”. “I think there is a lot of truth in the idea that if we convince the markets that this is going to be a powerful tool, we may not need it,” the Bank of Greece governor added. And “we will have it on the shelf. This is a good scenario.” In the face of record inflation, European Central Bank officials preparing for a series of interest rate increases are racing to ensure there is no negative reaction in bond markets for the most vulnerable members of the eurozone. And since a jump in Italian government revenue in June, they have accelerated work on a so-called anti-fragmentation tool, which policy makers have so far called the Transport Protection Mechanism.

Sturnaras’ comments recall the European Central Bank’s Explicit Monetary Transactions program that followed former President Mario Draghi’s famous pledge to do “whatever it takes” to hold the eurozone together amid the sovereign debt crisis. And in this case, his words were persuasive enough to never use OMT.

And while officials aren’t yet sure that the new tool will be ready for their July 21 decision, according to people familiar with the matter, Stournaras was more upbeat. But he declined to go into detail about the conditions that eurozone members would need to meet to be eligible for assistance.

He emphasized that the instrument was necessary, however, in the absence of broader reforms in the European Union.

The official said the European Central Bank’s plan to raise the deposit rate by a quarter of a point this month is likely to happen. With a bigger date for the next meeting, in September, Stournaras said, “We’ll see what the data says on the inflation front and also on the activity front.” He sees price growth starting to slow down towards the end of the year and approaching the medium-term target of 2% in 2024. It is currently more than four times that level. “I won’t be able to tell you where it will peak because it depends on external factors that can’t be measured by models,” Sturnaras added, and “maybe it depends on geopolitical considerations.”

The price increase will coincide with a slowdown in the 19-nation eurozone economy – an economy that could turn into a recession. Expectations of a downturn are growing as the possibility of a Russian power cut this winter becomes more real than ever. ING warned that a recession is coming regardless.

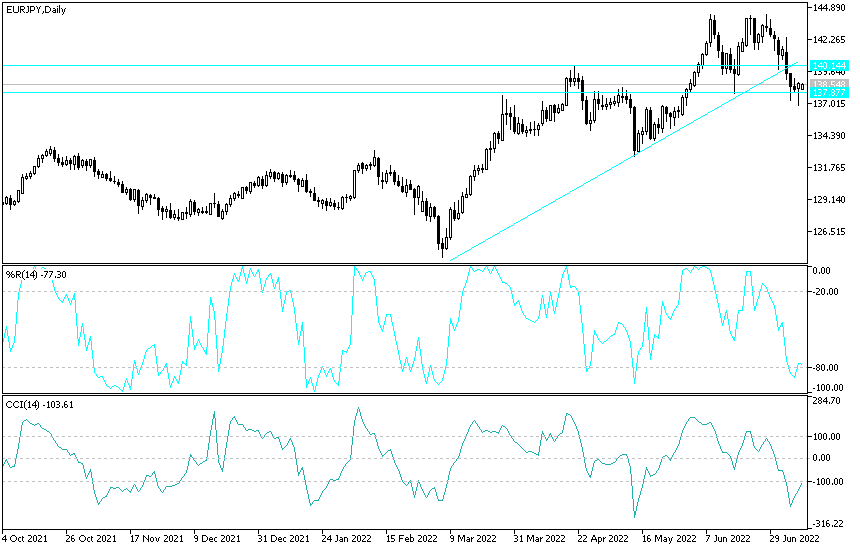

EUR/JPY Forecast

On the daily chart, the EUR/JPY is still within a bearish channel range, and despite the recent halt, the bears’ control is still the strongest and their control factors continue to lead a bleak future for the eurozone economy due to Russia’s pressure to cut gas from the bloc countries. The closest support levels for the current trend are 137.70, 136.80 and 135.00, respectively. On the upside the bulls won’t get back in control without moving above the 140.00 psychological resistance and so far I still prefer selling EURJPY from every bullish level.

[ad_2]