[ad_1]

There just is not enough clarity at the moment and it’s going to take a lot of psychology to break through the parity level.

US Dollar Continues to Strengthen

The US dollar continues to attract a lot of attention due to the fact that it is a bit of a safety bid, and of course people will be very cautious about putting a lot of money into a world market that is all over the place, and we have a lot of concerns when it comes to recession. In fact, it’s a bit counterintuitive, but if the United States is in fact in a recession, (and unless you are in the Biden administration, it is) the US dollar strengthens due to the fact that “when the US sneezes, the world catches a cold”, so goes the expression.

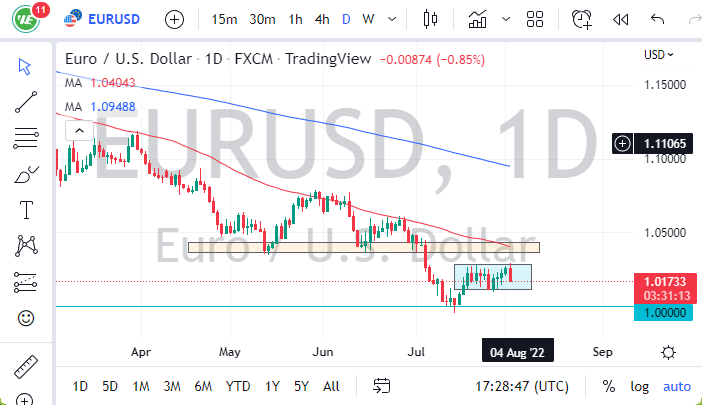

Furthermore, people are starting to buy bonds again, and that drives down yields, showing that people are jumping toward safety. The US dollar is a bit of a wrecking ball for the entire global markets, and the euro gets the brunt of the force as it is the “anti-dollar.” The 1.03 level is significant resistance, just as the 1.01 level is supported. We continue to bang around in this area, and once we break out of it, it could give us a bit of a “heads up” as to where we are going over the longer term.

I believe it’s more likely than not that we see a significant breakdown from here, but if we do rally, then the 50-day EMA is sitting right around the 1.04 level and dropping. The 1.04 level was previous support, so there should be a significant amount of “market memory” in this area. Either way, I think this is a market that I am going to remain very comfortable fading rallies until something changes from a fundamental standpoint. Until then, traders will probably continue to kick this thing back and forth. There just is not enough clarity at the moment and it’s going to take a lot of psychology to break through the parity level.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]