[ad_1]

For two weeks in a row the EUR/USD price tried to bounce higher and get out of the sharp bearish trend that pushed it below the parity price. The recent rebound gains did not exceed the resistance level of 1.0278, and last week its gains did not exceed the resistance level of 1.0255. It closed the same week’s trading around the level of 1.0225. This week, the euro dollar’s cautious gains will depend on the reaction to the announcement of the US jobs numbers. The price of the euro, which was already battered this year to its lowest level in two decades, remains an unpopular currency stuck under relentless pressure as its economy stumbles into recession.

It is hanging at just above parity with the dollar, after falling below that level earlier this month for the first time in more than two decades. The single European currency, the euro, has become a lightning rod for growing pessimism about the eurozone economy. It has fallen more than 10% against the dollar this year, and many analysts say the likely trend from here is further lower.

Much of the economic gloom is centered on the interruption of Russian energy supplies to Europe, which particularly threatens German industry. Accordingly, Credit Suisse sees a 50% chance that the Eurozone will fall into recession in the next six months. Goldman Sachs says he might already be in one.

Other concerns for current economic gloom

Italy is also a major concern amid the political turmoil that led to the departure of Italian Prime Minister Mario Draghi. Ratings agency Standard & Poor’s has lowered its outlook for the country’s debt, and a key measure of risk, the spread of Italian bond yields over Germany, is nearly the highest since 2020. Nerves about Italy’s departure from the euro are emerging in credit default swaps, though it is seen It’s a very remote danger.

From a price perspective, the euro has fared worse than it did in 2012 – the year’s low was $1.20. It was trading around $1.02 after falling to 99.52 US cents on July 14.

Therefore, JPMorgan Chase and Rabobank expect it will fall to 95 cents as Europe hits the energy crisis. Options pricing puts the odds of parity falling by the end of the year at around 70%. Bloomberg’s year-end forecast is $1.06.

But despite all this negativity, there is little talk that the region is heading for another existential crisis as it experienced a decade ago, when high debt levels and high bond yields led to speculation that the region could decouple. This eventually led to Draghi – at the time the head of the European Central Bank – saying he would do “whatever it takes” to protect the currency. The defection is a fringe idea now, and the European Central Bank has moved faster to keep markets in check.

Technical analysis of the EUR/USD pair:

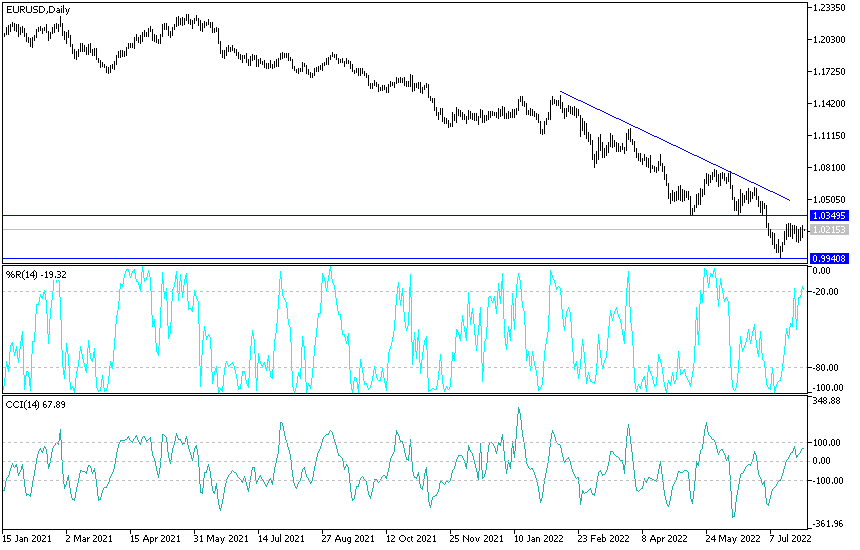

In the near term and according to the performance on the hourly chart, it appears that the EUR/USD is trading within an ascending channel formation. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will look to ride the current bounce towards 1.0236 or higher to 1.0266. On the other hand, the bears will target potential downside profits at around 1.0181 or lower at 1.0148.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current declines towards 1.0109 or lower to 1.0003. The bulls will target long-term profits at around 1.0305 or higher at the 1.0415 resistance.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]