[ad_1]

Euro exchange rates were flat at the start of the new week’s trading and at least some of the rally can be attributed to comments by a prominent member of the European Central Bank. European Central Bank Governing Council member Francois Villeroy de Gallo expressed concern that the euro was too weak and thus was contributing to inflation. Accordingly, the price of the EUR/USD currency pair moved towards the resistance level at 1.0453, bouncing back from the 1.0349 lowest support for the currency pair in five years. The euro recovered still needs stronger catalysts.

“Let me stress this: we will carefully monitor developments in the effective exchange rate as an important driver of imported inflation,” Villeroy said at a conference at the Bank of France. Some forex analysts have been warning that the European Central Bank may have to raise interest rates to defend the value of the euro in order to bring down inflation. Persistent euro weakness is making imported goods and dollar-denominated goods like oil and gas more expensive, fueling price pressures that have already pushed eurozone inflation to record levels.

The price of the euro reached its lowest level against the dollar since 2017 last week.

Villeroy’s comments add credence to the argument that the ECB may therefore be willing to raise interest rates on a number of occasions in 2022 to boost the value of the euro. “A very weak euro would interfere with our goal of price stability,” he added.

Villeroy said a “decisive” ECB Governing Council meeting can be expected in June, followed by an “active summer” on the monetary policy front. He indicated that the European Central Bank might consider raising interest rates “toward the neutral rate,” which would imply a move to 0% in the key deposit facility rate.

Eurozone money markets now show that investors are seeking 95 basis points for a rate hike from the European Central Bank in aggregate by the end of the year, compared to about 80 basis points priced at Friday. A move higher in interest rate expectations would exert higher mechanical momentum on the EUR.

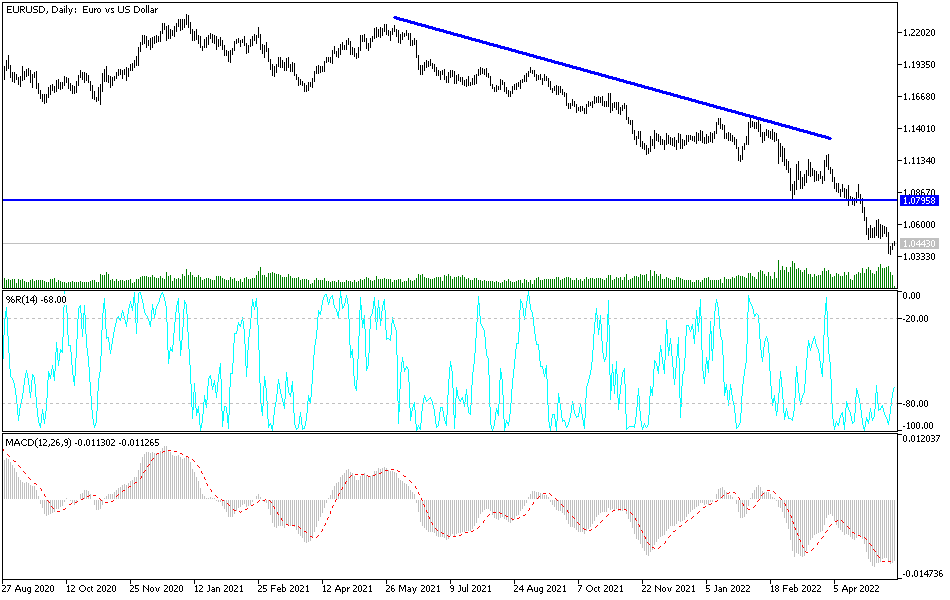

EUR/USD fell to a five-year low last week but may attempt a corrective recovery in the coming days if global markets find reasons to cheer on signs that China’s toughest “lockdown” to date may be coming to an end. The European single currency extended its nearly 18-month long downtrend with a dip to its lowest levels since 2017 last week, but it will likely try to recoup losses over the coming days after revealing that Shanghai is ready to begin a gradual reopening from China’s toughest shutdown.

The shutdown of Shanghai has been an important source of global market aversion in recent weeks because the city is home to China’s largest seaport, which is also the world’s most important for its importance in the international supply chains of commodity manufacturers.

Any early headwinds for the euro-dollar rate are likely to be mitigated by ongoing market concerns about the security of European energy supplies from Russia after Ukraine’s national gas pipeline operator halted some pipeline flows to Europe last week. The pause was followed by the Kremlin’s decision to ban gas sales and other transactions with a few important European companies, while both events together sparked fresh speculation about the risks of the euro sliding toward parity with the dollar in the coming weeks or months.

According to the technical analysis of the pair: The general trend of the EUR/USD currency pair is still bearish, and investors do not care about the arrival of technical indicators towards oversold levels. The continuation of the pressure factors on the currency pair that is mentioned a lot, is represented in the disparity in economic performance and the future of monetary policy tightening between The Federal Reserve Bank and the European Central Bank. Also most notably the continuation of the Russian war, which particularly affects the economy of the eurozone negatively.

The closest bears targets for the EURUSD price is to move towards the support levels 1.0325 and 1.0200 and then the parity price. On the other hand, according to the performance on the daily chart, breaking the resistance 1.0800 will be important in changing the trend.

[ad_2]