[ad_1]

GBP/USD made a solid rebound from the depths of its mid-month lows, but it may struggle for more momentum over the coming days. Major US economic reports capture the lion’s share of market attention in a period that will be quiet for them from UK economic calendar. The rebound gains for the GBP/USD pair stopped around the 1.2666 resistance level and settled around the 1.2650 level at the time of writing the analysis.

Last week, the British pound benefited from a broad decline in the US dollar, which kept the GBP/USD losses flat and short-lived even after the S&P Global Purchasing Managers Index surveys for May warned of tough times ahead for Britain’s most important services sector. Sterling’s recovery against the dollar was underpinned by the Treasury’s unveiling of a fiscal support package aimed at protecting retired families, the unemployed and other social welfare claimants from very high energy costs.

Since much of this targets welfare claimants for “tested means,” it is possible, if not likely that eligibility issues will also result in the exclusion or simply the exclusion of many low-income workers from such support, which could lead to continued risks to the economy and the pound later this year.

These will be headwinds over the medium term, while other factors are likely to dominate the GBP/USD rate this week.

It is not clear whether US factors such as declining market expectations for US interest rates and other recent international drivers, such as the increasingly broad easing of coronavirus containment measures in China, will remain supportive of the British pound and other currencies over the coming days.

Lee Hardman, currency strategist at MUFG, warns that the dollar could be weak for another corrective setback. The US dollar fell last week amid indications that large parts of the Chinese economy may be emerging from a hibernation caused by the Corona virus, and after some US economic data, including figures related to the service sector, housing market and business investment figures indicated the weakness of the economy.

The US data has encouraged speculation about a possible slowdown in the pace at which the Fed is likely to raise interest rates later this year, speculation that was substantiated to some extent by the minutes of the bank’s May meeting. The minutes suggested that some Fed policymakers might be open to the idea of a pause in the “tightening cycle” if they receive “clear and convincing evidence” that US inflation is falling back to the Bank’s 2% target.

US inflation data is still a bit far from providing the “clear and convincing evidence” that is a prerequisite for any Fed decision to slow or pause the monetary tightening cycle, although that hasn’t stopped the market from pulling back a bit. about US interest rate expectations. The core PCE price index for April provided an additional indication last Friday that inflation pressures may ease, and this is the context in which the market is likely to assess this week’s US economic figures.

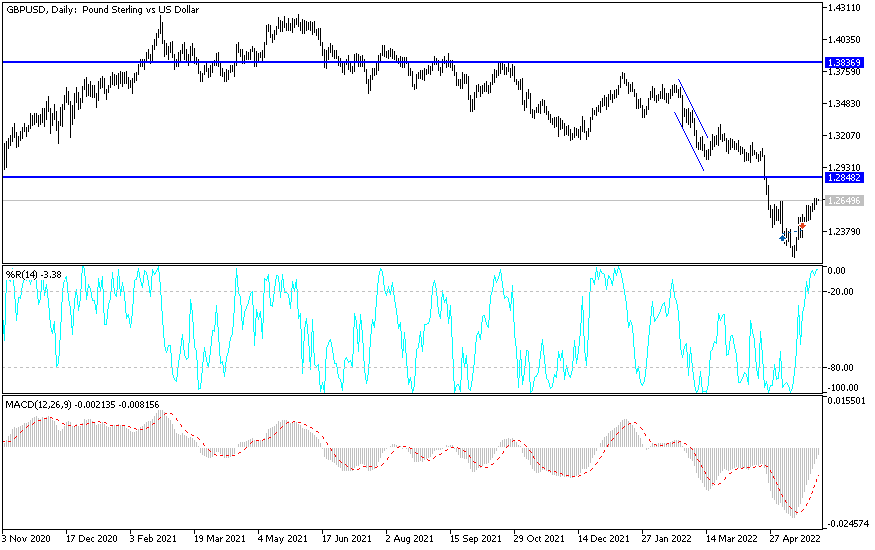

According to the technical analysis of the pair: There is no change in my technical view of the currency pair. On the daily chart below, the price of the GBP/USD currency pair started forming an ascending channel opposite to the broader bearish channel. As mentioned before, the breach of the 1.3000 psychological resistance will be important for a stronger and continuous control for bulls on trend. The current trend will continue to face a threat if the currency pair returns to the vicinity of the support levels 1.2490 and 1.2350, respectively.

I still prefer to sell the currency pair from every bullish level as the factors of the strength of the US dollar are continuing and may remain for a long time.

[ad_2]