[ad_1]

Recently, the GBP/USD exchange rate clung to a lot of gains in the wake of the Bank of England’s June policy decision but without any further corrective drop by the dollar, the pound is likely to consolidate within a range of approximately 1.2171 to 1.2323 during the trading session. The British pound drew bids from the market near 1.22 or below last week after it appeared to be benefiting from signs of a more hawkish slant in the Bank of England’s monetary policy stance as well as what was, for the most part, a softer US dollar.

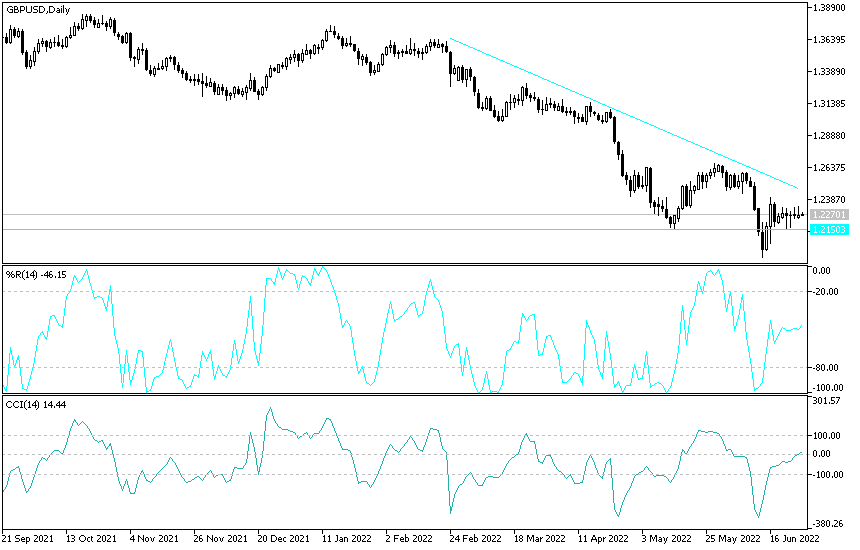

The price of the pound sterling against the dollar, GBP/USD, is stabilizing around the 1.2270 level at the time of writing the analysis.

In general, the US dollar fell against most of the major currencies last week even as financial markets regressed to their expectations regarding the interest rates of the US Federal Reserve, the Bank of England and many other central banks amid a significant increase in market concerns about the global economic outlook. Commenting on this, Juan Manuel Herrera, analyst at Scotiabank said, “Range trading all this week provides us with little in terms of technical guidance, but the pound’s failure to hold above 1.23 suggests that the near-term upside is limited after an unsuccessful test at 1.24. last week”.

The analyst added, “The support is the lowest price during the day at 1.2240, followed by 1.2220, and the resistance after the 1.23 and 1.2324 figure area is the middle of 1.23.”

The market’s implied expectations for the Fed’s end-of-year 25 basis point mid-point fell from 3.45% to 3.36% last week while the equivalent figure for the end of 2023 fell from 3.3% to 3% last week. According to several analyst accounts, the drop in market expectations was a result of comments by Federal Reserve Chairman Jerome Powell, who told Congress that it would be difficult for the Fed to bring down inflation without disrupting the labor market or hurting the economy. In other words, achieving a smooth landing will not be easy. So, Tom Kenny, chief economist at ANZ, said it was not the Fed’s intention to cause a recession, but acknowledged it was a possibility.

A growing group of Fed officials are leaning toward another 75 basis point hike at the FOMC July 26-27 meeting. We expect a higher CPI reading for June (scheduled for July 13) will see a repeat of the Fed’s decision in June.”

The price of the US dollar fell after the recent testimony of Jerome Powell, which helped the price of the pound against the dollar to remain supported above the 1.22 level in the process. Despite the series of British economic numbers that also forced the markets to curb expectations about the Bank of England interest rate at the end general. “The UK PMIs for June surprised to the upside, staying flat compared to the previous month, with the release gaining more prominence given the sharp contrast to the Eurozone and US numbers,” says Chris Turner, analyst at ING Bank.

“GBP/USD may remain in the 1.22-1.23 range for now, while EUR/GBP may continue falling towards the lower half of the 0.8500-0.8600 range,” the analyst added.

The forecast of the pound sterling against the dollar:

The trading strategy of selling the GBP/USD currency pair from every bullish level is still the most appropriate for the performance of the currency pair. The concern stemming from the Bank of England about an economic recession coinciding with raising interest rates and British political anxiety and the followers of the US central bank is still more hawkish policy factors supports this strategy. Currently, the closest rebound targets are 1.2325 and 1.2420, respectively.

On the other hand, the return of the sterling dollar pair towards the support level 1.2175 will restore expectations for a stronger bearish move towards the psychological support 1.2000, respectively.

[ad_2]