[ad_1]

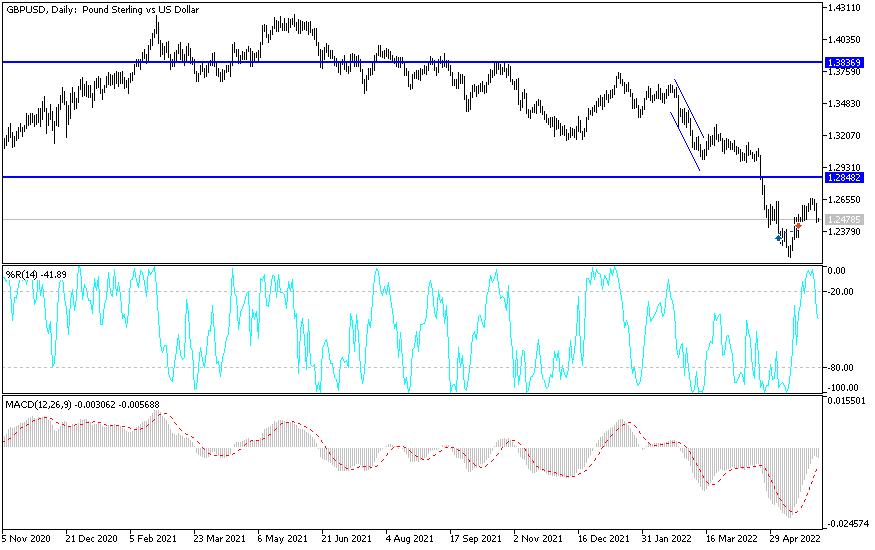

All the gains of the GBP/USD currency pair collapsed since trading last week during yesterday’s session. It was exposed to selling operations that pushed it towards the support level 1.2458 after the recent rebound gains, it reached the resistance level of 1.2666, and settled around the 1.2491 level at the time of writing the analysis. The selling operations came as investors returned to buying the US dollar as a haven, in addition to the stronger expectations of the future of raising US interest rates. We are also preparing for the announcement of US jobs numbers today and tomorrow, which may constitute the future of the closing week’s trading for the currency pair.

The British Pound has become the subject of increasingly bearish and extensive press coverage in recent days following a number of suggestions from within the analyst community that it may be on the cusp of a major downward move. But much about the emerging narrative only reflects a repetition of long-standing, polluted views of Brexit, which have gained little market momentum since the end of December 2020 for the Brexit transition period, giving renewed importance to the following October 2021 note.

Meanwhile, the new elements reported in the Sterling trial are couched deeply within the questionable idea that the UK is somewhat of an exception to the European economic trend toward high inflation and a low growth environment that is partly the result of Russia’s invasion of Ukraine. There are also inadvertently self-defeating suggestions of a “connectivity problem” at the BoE as well as allegations that the BoE may struggle to keep pace with peers as interest rates rise in order to rein in hyperinflation over the coming months.

Inflation continues to rise and reached 5.2% in May, while first-quarter GDP was revised down.

According to the technical analysis of the pair: the recent move threatens the future of the bullish channel for the GBP/USD currency pair, which was formed recently. The bears’ control will increase again if the currency pair moves towards the support levels 1.2440 and 1.2360, respectively. As I mentioned before, the breach of the 1.3000 psychological resistance will remain of great importance to break the current bearish outlook for the currency pair.

Amid the British holiday today, the GBP/USD pair will all focus on the US ADP economic data for the change in non-farm employment, weekly jobless claims, non-farm productivity rate and US factory orders.

[ad_2]