[ad_1]

I think a pullback is imminent, and probably healthy if you are bullish longer-term.

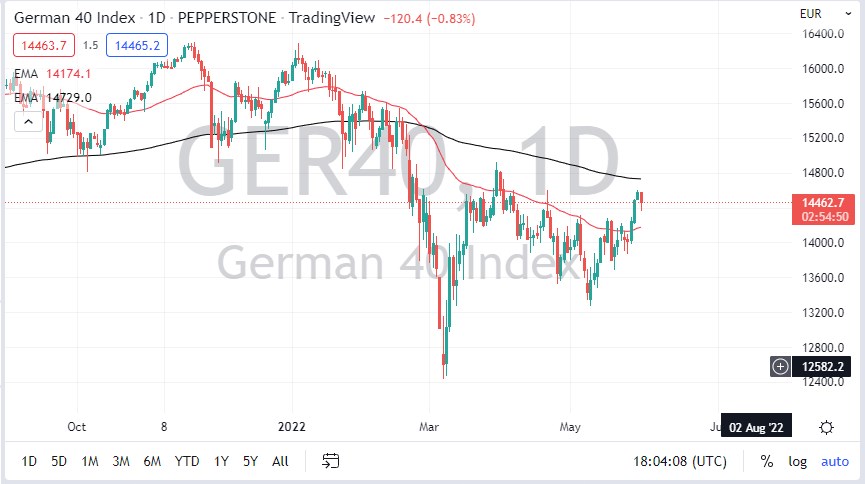

The DAX fell a bit on Tuesday to break down below the €14,400 level, giving back some of the gains from the recent surge higher. The DAX I had gotten rather close to the 200-day EMA, which has a major influence on longer-term traders. Furthermore, there was quite a bit of horizontal resistance in this area, so it’s not a huge surprise to see that we gave up some gains. Furthermore, a lot of the fundamental situation has not changed so one has to wonder whether or not this was a “bear market rally” to begin with.

Looking at the candlestick for the day does suggest that we could get a little bit further weakness, but I would anticipate that there should be interest in the DAX near the 50-day EMA underneath, which is currently higher. In other words, I think the downside is certainly possible, but it may be a bit limited. As long as that’s the case, then I think we will continue to see more chop than anything else. It’s probably worth noting that we did break above a significant downtrend line recently, so it is possible that we will continue to try to recover. However, the fundamental situation is so tenuous around the world that it’s a bit of a reach to get overly excited at this point.

The market has been very noisy as of late, and by the market, I don’t necessarily mean just the DAX, but stocks in general. There are a lot of concerns when it comes to inflation and global growth. Germany is a major exporter to not only the rest of the European Union, but the rest of the world for that matter, so how things behave in other parts of the globe will have a major influence on what we see here in German equities. As long as there are concerns about export economies not being able to purchase goods, it’s difficult to see how the DAX has true traction. If we break above the €15,000 level, then we can revisit a longer-term trade, but in the meantime, I think a pullback is imminent, and probably healthy if you are bullish longer-term. Underneath, see the €13,600 level as a potential support level that traders will focus on.

[ad_2]