[ad_1]

Despite the positive numbers of the jobs and wages market in Britain, the markets have commented on the future of tightening the Bank of England’s policy on the recent statements of its officials that the Bank will not be in a hurry for more of the rate hikes. This explains the recent collapse of the pound against the rest of the other major currencies. For four trading sessions in a row, the GBP/USD pair is trying to destabilize below the 1.3000 psychological support level so as not to increase the pound’s suffering.

The GBP/USD pair is currently stabilizing around the 1.3000 level, waiting for anything new based on the last performance. The GBP/USD exchange rate could make a meaningful recovery in mid-2022, according to a new analysis. The US dollar will see the end of its multi-year rising trend and begin to decline from July according to Westpac, the multinational bank and financial services provider in Australia.

The drivers of the dollar’s continued strength include the superior yields offered on US bonds, thanks to the Fed’s race to raise interest rates. The US central bank is expected to raise interest rates by 50 basis points in its next two meetings, after which it is expected to raise an additional 25 basis points.

Investor concerns about the war in Ukraine are also driving up demand for the highly liquid dollar, which tends to benefit when the demand for liquidity increases.

Accordingly, Westpac economists see negative growth pressures as dependent on the dismantling of fiscal support and a material decline in real wages, as well as rapid monetary tightening. Accordingly, analysts say, “These facts are behind our expectations that the US dollar is approaching a peak, and the downtrend will likely start from July once the FOMC provides another 100 basis points of fed funds rate increases and the start of quantitative tightening.”

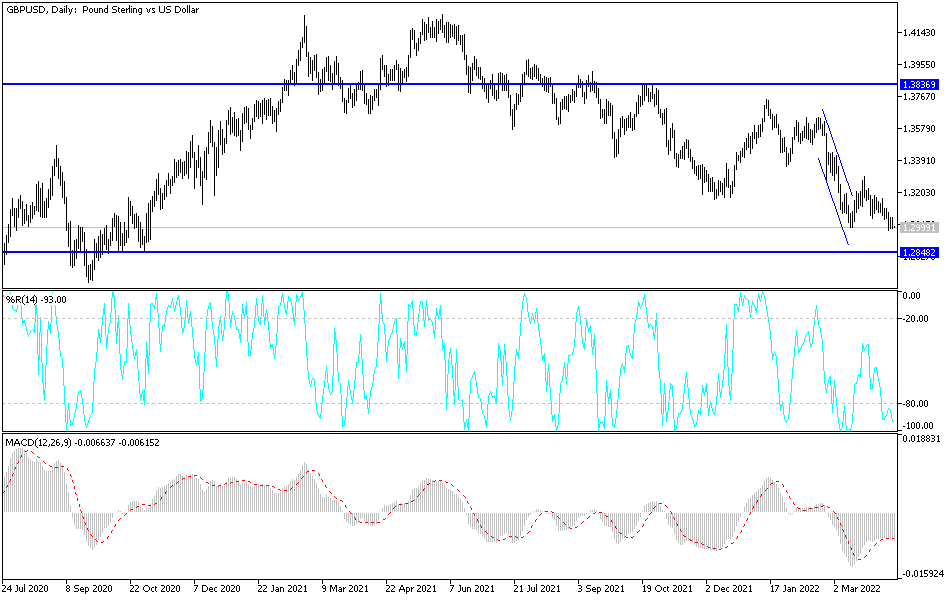

At this point, the British pound may find itself in a better position to rise. Sterling has fallen from a peak of 1.4250 in May 2021 to current levels near 1.30, with an imminent breakout below 1.30 now likely.

According to the technical analysis of the pair: The GBP/USD price’s breach of the 1.3000 psychological support level is still important for more bears’ control of the trend and warns of a stronger bearish move. Therefore, the next psychological support may be 1.2685, the next target according to the performance on the daily chart, and this may happen If the US dollar continues to reap its gains with expectations of raising US interest rates and the continued strength of the US economy. If the Bank of England changes its view that it is ready to re-tighten its policy aggressively during the year, the Sterling may gain momentum to activate strong long positions again.

As I mentioned before and according to the performance on the daily chart, there is a need to break the resistance 1.3335 to confirm the turn of the GBP/USD direction to the upside. The Sterling will be affected today by the announcement of British inflation figures. The dollar will be affected by the announcement of the US producer price index reading.

[ad_2]