[ad_1]

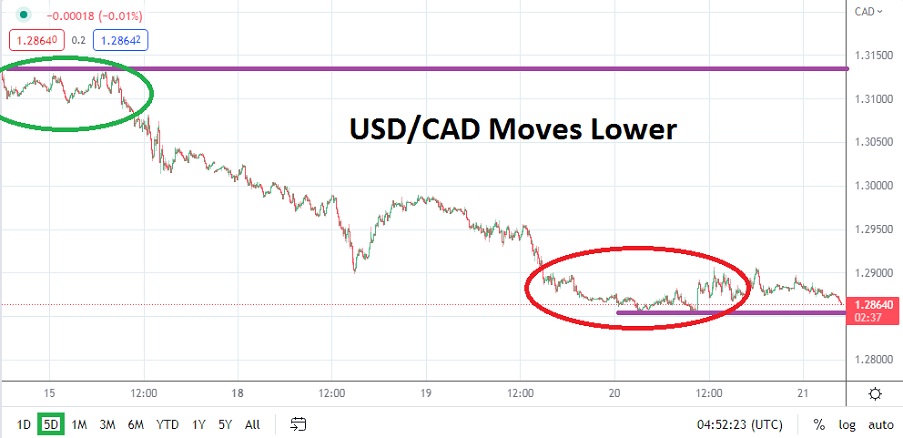

The USD/CAD is flirting with short term lows and the trend for the currency pair suddenly is starting to show signs of bearishness, but is it real?

The USD/CAD currency pair is trading near the 1.28650 level as of this writing. Suddenly the USD/CAD is flirting with prices not seen since the first week of July in a sustained manner. Yesterday’s approximate low of 1.28550 touched values not seen since the 5th of July. Short term traders, who are technically inclined, suddenly have a reason to consider downside momentum as a serious possibility. However wagering against the established long term bullish trajectory of the USD/CAD currency pair could prove extremely dangerous.

The USD/CAD like all of Forex is Producing Volatility and Speculative Opportunities

While the movement down might prove tempting for traders to pursue – and they might be proven correct – the volatility of the USD/CAD and all of Forex has been strong recently, and choppy conditions could prove treacherous. Some experienced traders who have been participating in the upside track of the USD/CAD may believe that a ‘trap’ is being set and that the lower move of the currency pair will start to reverse higher. While this is quite possible, the USD/CAD may also be displaying signs that the bullish trend may be starting to loss power.

- Short term trend of the USD/CAD is suddenly challenging early July value as downside momentum grows stronger.

- Volatility could prove dangerous if a strong reversal starts to prove resistance is weak and the USD/CAD bullish trend is sparked again.

The near term is beginning to show signs of danger for speculators. If current support levels start to falter and the USD/CAD breaks below yesterday’s lows and begins to earnestly sustain lower values, and flirt with the 1.28390 ratio, this would be an indicator behavioral sentiment may be shifting. However, reversals lower within the long term bullish trend of the USD/CAD have been seen before and proven false hopes.

If early July Support Levels Prove Durable the current Selling may Fade Away Quickly

Risk management will be critical the last two trading days of this week, in fact next week could be even more dangerous. Fundamentally financial institutions have digested the U.S Fed’s interest rate hike which will be delivered next week already. If these trading houses also believe inflation is about to be tamed, this could set the table for a true bearish trend in the USD/CAD to start being sustained. But is inflation really about to erode quickly?

Timing market shifts is notoriously hard. The past week has seen the USD/CAD begin to show signs of stronger selling. Traders brave enough to short the USD/CAD may be making the correct wager, but short term choppy conditions should be expected.

Canadian Dollar Short-Term Outlook

Current Resistance: 1.28740

Current Support: 1.28553

High Target: 1.29068

Low Target: 1.28170

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]