[ad_1]

The rise in US inflation levels coincided with the decline in US Treasury bond yields. Therefore, the gold price had the opportunity to move upwards strongly towards the resistance level of 1979 dollars an ounce, its highest in a month.

Gold futures rose after price inflation in the US was hot again in March. Despite expectations that the Federal Reserve will be bolder about US interest rates, the yellow metal is still heading towards its highest end in about a month. Gold prices have been in a tailspin during last month’s trading, rising nearly 3%. Since the beginning of the year 2022 to date, the price of the yellow metal has increased by about 8%.

As for the price of silver, the sister commodity to gold, it is looking to top $26. Silver futures rose to $25.74 an ounce. Overall, the price of the white metal increased by more than 5% over the past week, bringing its gains in 2022 to more than 10%.

Precious metals prices, which are usually a safe haven in an inflationary environment, rose in the wake of the March inflation data.

According to the US Bureau of Labor Statistics (BLS), annual US inflation came in at 8.5% last month, beating economists’ expectations of 8.4%. This was also up from 7.9% in February. Core inflation, which is decimating the volatile food and energy sectors, also jumped to 6.5%. But market analysts are divided over whether this is the peak of inflation or if there are further increases on the horizon for next month’s report. At the moment, there are two immediate factors that can dampen inflation: China and the Federal Reserve.

Experts stress that inflation could decline if the US central bank becomes bolder about interest rates. For his part, St. Louis Fed President James Bullard wants to see the benchmark rate at 3.5% by the end of the year. Minutes from the Federal Open Market Committee (FOMC) last month revealed that the institution plans to raise the federal funds rate by 50 basis points in May and June.

Moreover, the lockdowns in China are expected to exacerbate the global supply chain crisis. Experts say Beijing needs to accept that COVID-19 will never go away and that putting important financial centers under lockdown will not achieve its COVID Zero strategy. If the Chinese leadership accepts this, inflation may weaken.

Gold is usually sensitive to higher interest rates because it raises the opportunity cost of holding non-returning bullion.

Precious metals’ gains capped the dollar’s rally as the US Dollar Index (DXY) rose to 100.09, from an opening at 99.93. A stronger profit is generally a bad thing for dollar-priced commodities because it makes it more expensive for foreign investors to buy it. US Treasury yields were red across the board, with benchmark 10-year yields falling to 2.678%. The yield on the one-year note fell to 1.735%, while the yield on the 30-year note fell to 2.785%.

Relative to the prices of other metals, copper futures rose to $4.7115 a pound. Platinum futures rose to $979.20 an ounce. Palladium futures fell to $2365.00 an ounce.

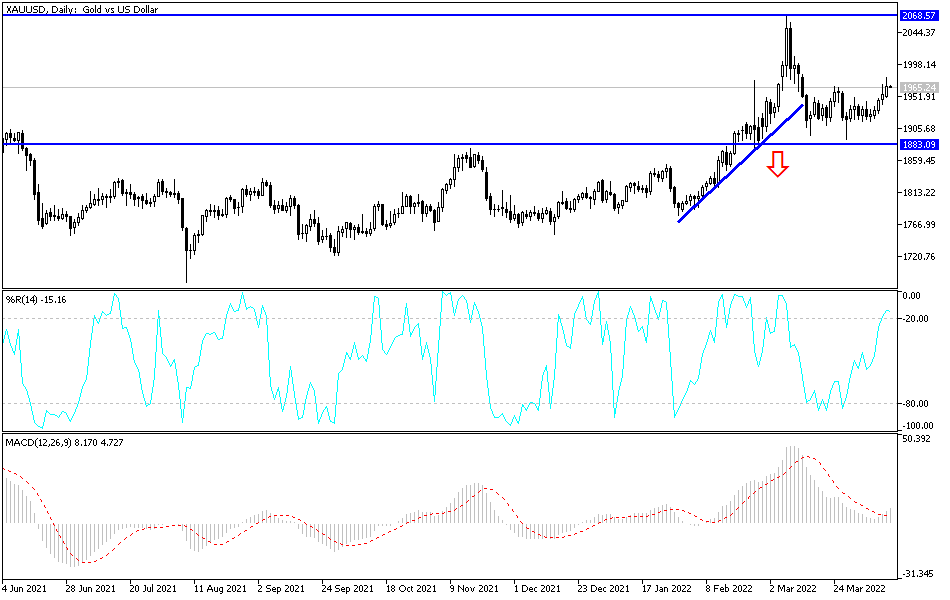

According to the technical analysis of gold: The movement of bulls in the price of gold to breach the resistance of 1975 dollars an ounce may increase the strength of expectations to move towards the next historical psychological top of 2000 dollars an ounce. This may give the bulls an impetus to break through stronger historical ascending levels. On the other hand, according to the performance on the daily chart, the breach of the 1920-dollar support will be important to shift the bullish outlook, and so far, I still prefer buying gold from every descending level as long as global geopolitical tension and the epidemic are ongoing factors. Gold is a traditional and historical safe haven for investors from any turmoil.

[ad_2]