[ad_1]

The recent cautious stability of the gold price may move strongly, starting from today and ending tomorrow. Today, the European Central Bank will announce an official date for moving interest rates, and tomorrow the US inflation numbers will be announced.

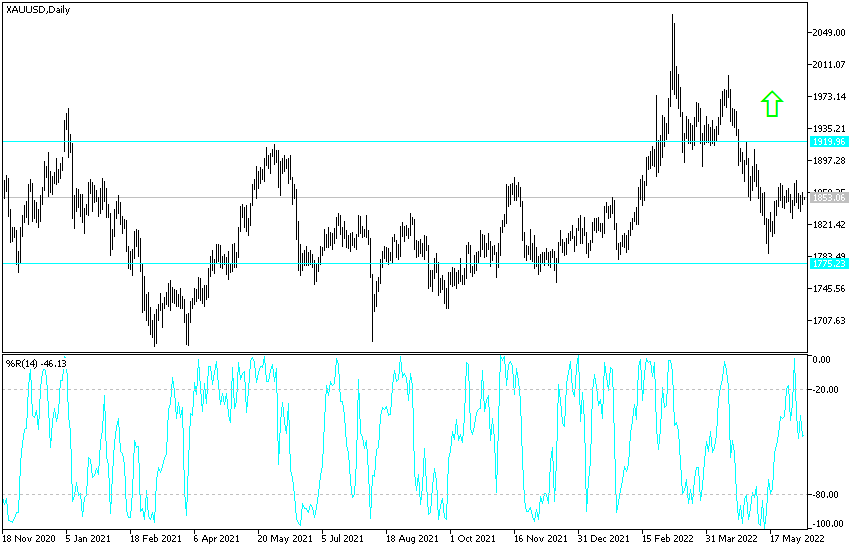

These both have the most impact on the path of gold, and they will shape the future of closing the price of the yellow metal for this week and what it will be next week. For three trading sessions in a row, the price of gold is moving in a range between the level of $1837 an ounce and the resistance level of $1860 an ounce, and it is settling around the $1850 level.

The gold market got some impetus from the announcement that global central banks are going to buy more gold. Global central banks see gold as a reserve asset and are likely to increase their holdings of the metal in the next twelve months, according to a survey by the World Gold Council. This is mainly due to growing concerns about a possible global financial crisis, as central banks in emerging markets and developing economies, or about a quarter of respondents, intend to add more bullion to their reserves. This is a slight increase from 21% in 2021.

Expected changes in the international monetary system and concerns about increased economic risks in reserve currency economies are also key factors, the survey said. Add to that rising inflation, monetary tightening and the Russian war in Ukraine, further disrupting supply chains and bringing geopolitical uncertainty. Commenting on this, Shaukai Fan, the global head of central banks at the WGC, said in an interview: “The geopolitical situation is more volatile, and we don’t know how long this situation will continue.” And “what happened is that gold proved its safe haven properties during that case. And that’s one aspect that central banks are thinking about.”

Fan Pan added that central banks in emerging markets are optimistic about the future of gold in the international monetary system, and they stand on the fence on the US dollar. The survey also showed that the majority of these respondents expect gold to grow in proportion to total reserves over the coming years, while its attributes as a safe haven for value and ability to perform in times of crisis will remain influential.

The poll was conducted between February 23 and April 29 with a total of 57 responses.

US stocks rose for a second day in a row, even as the World Bank sharply cut its forecast for global economic growth this year, highlighting Russia’s war against Ukraine and the potential for food shortages and a possible return to “stagflation,” a toxic combination of inflation and slow growth unseen since More than four decades. For her part, US Treasury Secretary Janet Yellen, in her testimony before the Senate Finance Committee, said that she expects inflation to remain high and that reducing it is a top priority. More data on recent price swings will arrive Friday when the US releases the US Consumer Price Index, which strips out volatile food and energy prices.

The fragility of the economy has been on the minds of Wall Street this year amid concerns about an interest rate hike by the Federal Reserve. The US central bank is moving aggressively to stamp out the worst inflation in decades, but it risks strangling the economy if it moves too far or too quickly. The Federal Reserve is widely expected to raise its key short-term interest rate by half a percentage point at its meeting next week. This will be the second straight increase to double the usual amount, and investors are expecting a third increase in July.

Gold technical analysis: On the daily chart, there is a neutrality in the performance of the gold price, and the tendency will be more to the upside if prices move towards the resistance levels of 1875 and 1888 dollars. The last level is important to move towards the psychological resistance of 1900 dollars, respectively. The upside trend may be shaken today if the European Central Bank confirms the date to tighten its policy and follow the same path as other global central banks, but I still prefer buying gold from every descending level and the most suitable for buying if this happens, the support levels of 1837 and 1820 dollars, respectively.

[ad_2]