[ad_1]

The stronger and continuous control of the bulls on the price performance of the USD/JPY currency pair pushed it towards the 135.20 resistance level, the highest for the currency pair in 20 years. It is settling around the 134.50 level at the time of writing the analysis, and the move may remain stable around its gains until the US central bank policy is updated tomorrow, Wednesday. Expectations of a sharp rise in US interest rates throughout 2022 guarantee the US dollar strong gains in the forex currency market.

In the view of Barclays experts, “We believe that the FOMC now has good reason to surprise the markets by walking more strongly than expected in June. Accordingly, we have changed our forecast to call for a 75 basis point increase.” The Federal Reserve is widely expected to raise US interest rates via a massive 50 basis point increase, which would bring the Fed funds rate to a range of 1.25% to 1.5%, although US inflation data on Friday increased the risks of the bank going forward this week.

That data suggests that US inflation could remain above the Fed’s 2% target for much longer than the bank had projected, and so may ultimately leave the Fed with little choice but to continue raising rates in larger-than-normal increases.

This could lead to the Federal Reserve raising US interest rates to 3% or more by the end of the year, which would be very supportive of the dollar, and another drag on the other currencies. “Inflation is very high in major developed markets, and central banks need to tighten financial conditions to slow the economy and bring down inflation,” says Zach Bundle, forex analyst at Goldman Sachs.

“At some point financial conditions will tighten enough and/or growth will weaken enough that the Fed can stop taking a walk.” “But we are still far from that point, which indicates upside risks to bond yields, continued pressure on risky assets, and the potential for broad strength in the US dollar for the time being,” the analyst said.

A measure of US dollar strength rose to its highest level since the early months of the pandemic as investors bet that the Federal Reserve would ramp up monetary policy tightening. Accordingly, the Bloomberg Dollar Spot Index, which measures the performance of the US currency against a basket of ten leading global currencies, rose 0.8% to the highest level since April 2020. The measure is on track for its largest gain in two sessions since March 2020. The last stage of data was stimulated US inflation came in higher than expected on Friday, prompting traders to bet on faster rate increases. They are now pricing in a full 75 basis point hike by September, which would be the US central bank’s biggest hike since 1994.

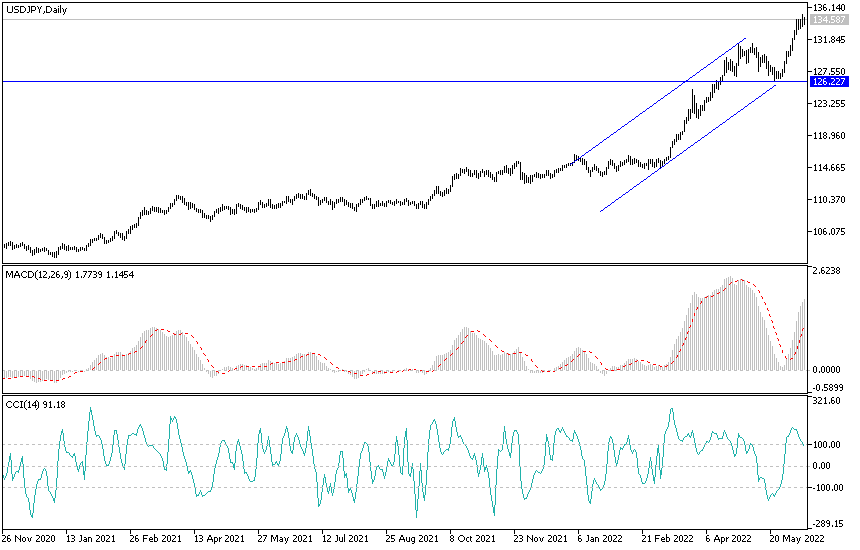

According to the technical analysis of the pair: There is no change in my technical view of the price performance of the USD/JPY currency pair, as the general trend is still bullish. It may maintain its gains around the highest in 20 years until the US Central Bank announced on Wednesday the closest targets for the bulls. According to the current performance, the resistance levels are 134.85, 135.20 and 136.00, respectively.

On the other hand, according to the performance on the daily chart, it will be important to break the 130.65 support level to start controlling the bears. The US dollar will be affected today by the announcement of inflation readings from the producer price index.

[ad_2]