[ad_1]

In the middle of this week’s trading the British pound was stronger, in line with some better than expected economic data. UK GDP rose 0.5% in the months to May, the Office for National Statistics said, beating expectations of 0.1% growth and returning to growth after hitting -0.2% in April. In the three months to May, the UK economy grew by 0.4%, better than expectations of 0%.

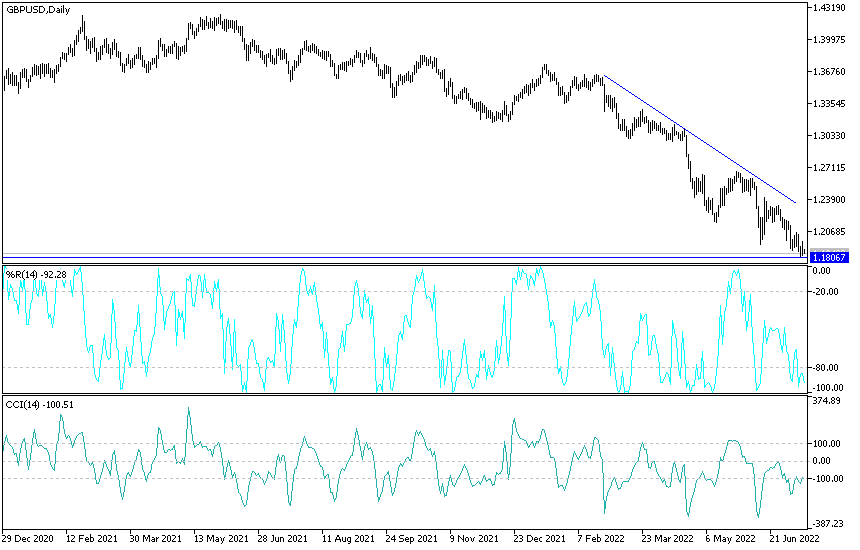

According to the performance of the GBP/USD pair, it moved from the 1.1827 lowest support since March 2020 to the 1.1967 level, but the sterling weakness factors continue and the US dollar is receiving strong momentum from US inflation figures that support the path of tightening the Fed’s policy, and accordingly, the GBP/USD has returned to its descending path, stable around the 1.1840 level at the time of writing the analysis.

Commenting on the growth rate of the British economy. “It may actually be OK in the UK given the latest GDP report,” says Viraj Patel, an analyst at Vanda Research. All components of the British economy contributed to better-than-expected data: industrial production rose by 2.3% in the month to May versus expectations of 0.2%.

Manufacturing production grew 0.9% against expectations of production stability and construction production increased by 4.8% versus 4.4% expected. The all-important index of services – important because it represents the largest sector of the British economy – rose 0.1%, beating expectations of -0.1%. The outlook is hit in the face of the negative consensus towards the UK economy and thus supports the Sterling in a balanced way. Accordingly, Neil Pearl, chief investment officer at Premier Miton Investors, says: “In a sudden turn of events, UK economic data has been very good relative to the outlook and recent trends.” international community given the issues in the UK at the moment.”

Looking ahead, Gabriella Dickens, chief economist at Pantheon Macroeconomics, says, “The May GDP data did not change our expectations for contraction in the second quarter.” Pantheon estimates that the extra bank holiday for the Queen’s Jubilee – which will be treated as a special event by the Office for National Statistics and therefore cut seasonally adjusted data – will cause GDP to fall by about 1.5% per month in June.

Meanwhile, consumer confidence readings remain low confirming that the service sector is likely to see continued headwinds. Accordingly, Dickens says: “Nevertheless, a recession – two consecutive quarters of negative growth – is still unlikely. Real disposable income for households should rise in the third quarter, in response to the increase in the threshold for NI contributions and cost-of-living grants from the government.

GBP/USD Analysis

The general trend of the GBP/USD pair is bearish, and the stability is still below the psychological support 1.2000. It still supports the bears for further movement down. Amid the continuation of the factors of sterling weakness and the factors of the strength of the US dollar, the currency pair is subject to further movement downward, and the closest support levels to the current trend are 1.1800 and 1.1735. and 1.1600, respectively.

On the upside, and according to the performance on the daily chart, a break of the resistance levels 1.2090 and 1.2300 will be important for the bulls, and in general, the GBP/USD gains will remain subject to selling in the coming days. There are no important British data, so the focus will be on the US data, the Producer Price Index and the number of weekly jobless claims.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]